Dec 19, 2025

Crypto investors turn cautious as downturn reshapes strategies

Crypto markets have seen investors shift toward more defensive positioning as the latest selloff hit some of the industry’s most popular segments. Reuters reported that the pullback is pushing more participants toward active strategies and risk management, while some bitcoin mining firms are increasingly pivoting business models toward AI data-center work to diversify revenue. The broader message from market participants is that easy momentum has faded and investors are focusing more on liquidity, carry, and balance-sheet resilience. The rotation underscores how quickly sentiment can change after a sharp drawdown.

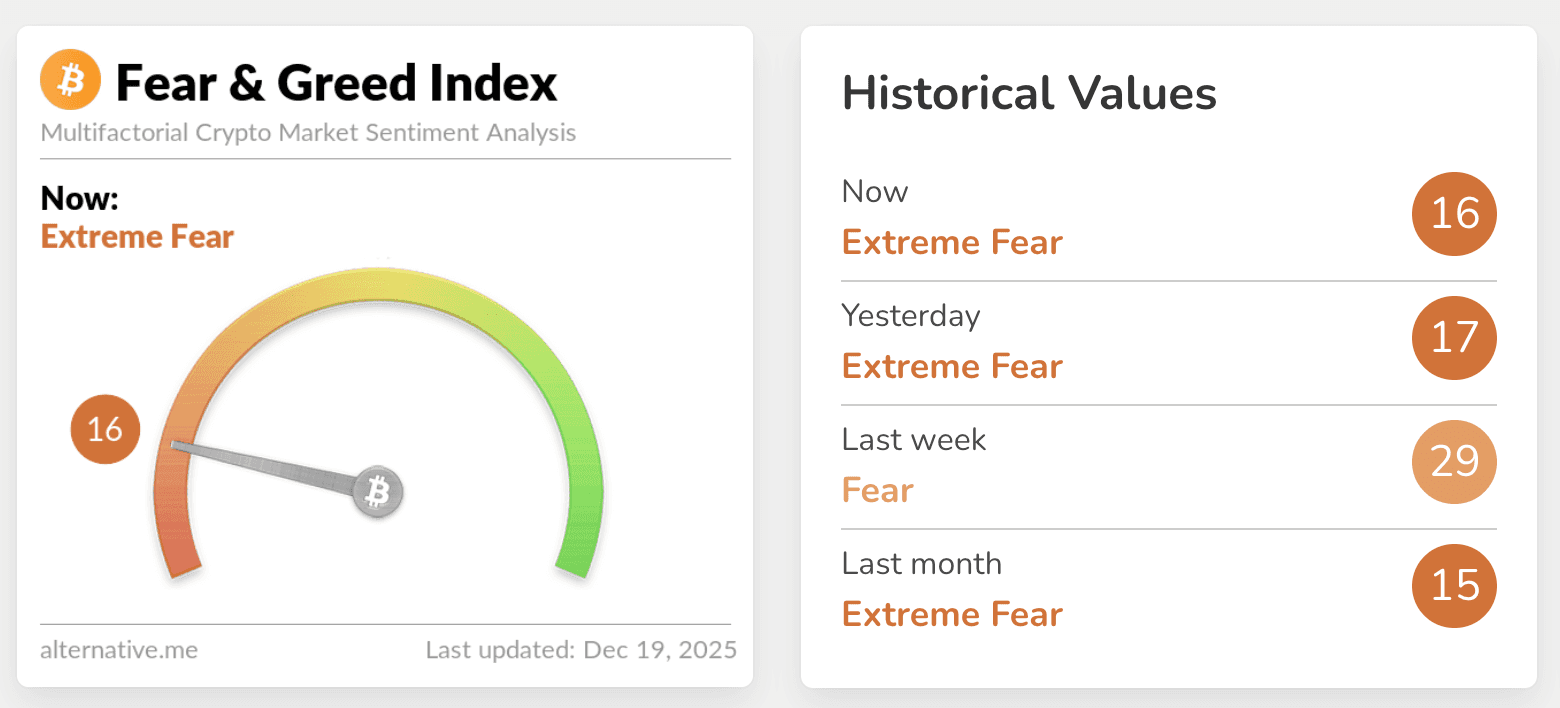

Fear & Greed Index hovers near extreme fear as traders stay defensive

Crypto market sentiment deteriorated further into the end of the week, with the Crypto Fear & Greed Index falling to a reading of 16 on Friday, firmly in “Extreme Fear” territory. Data from Alternative.me showed the index slipping from 17 the prior day and well below last week’s reading of 29, highlighting how quickly confidence has eroded. Such low levels typically reflect widespread risk aversion, reduced leverage, and traders prioritizing capital preservation over new exposure. Historically, extended periods of extreme fear are associated with thin liquidity and heightened sensitivity to macro and policy headlines.

Crypto in 2025: A Year of Quiet Maturation

2025 wasn’t the year crypto dominated headlines, it was the year it quietly grew up. After years defined by hype cycles and high-profile failures, the industry shifted its focus toward foundations: clearer regulation, institutional-grade infrastructure, and real-world use cases that extend beyond trading. Stablecoins moved closer to becoming financial plumbing, tokenization advanced behind the scenes, and the line between traditional finance and crypto continued to narrow. Trust, governance, and operational discipline mattered more than speed. For a deeper reflection on how crypto went mainstream in unexpected ways this year, Paul Grey’s year-in-review captures the shift well: https://x.com/paulgrey/status/2001050714043519310

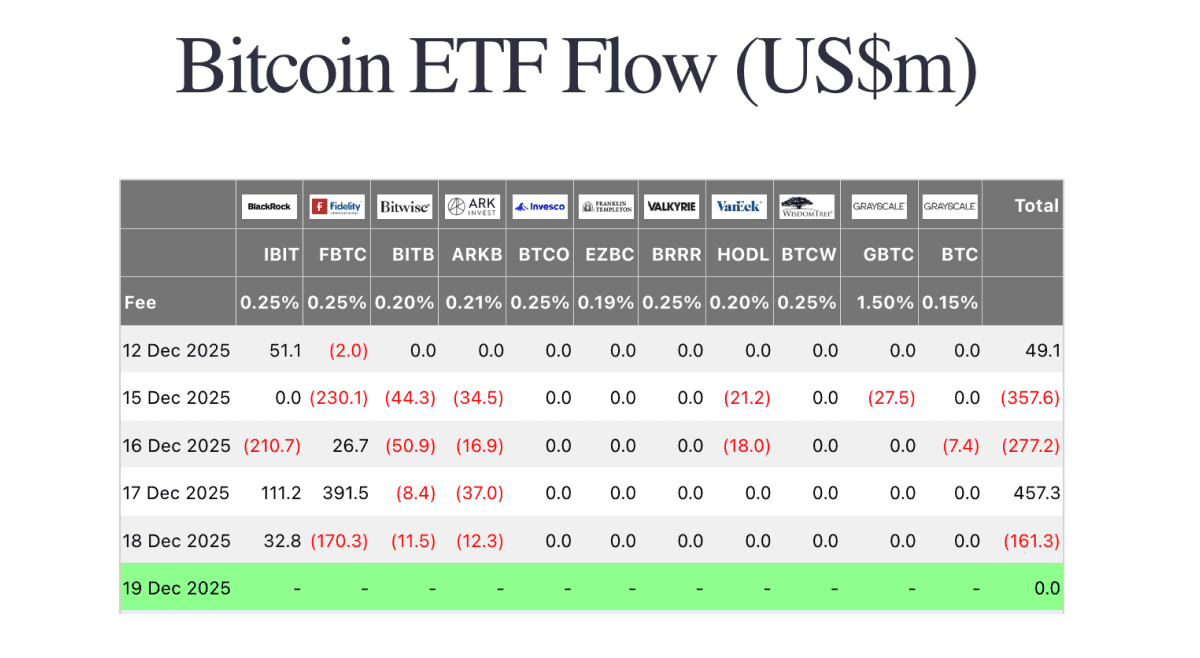

Bitcoin ETF Flows

Monday (Dec. 15) saw bitcoin ETFs post a net -$357.6m, driven by heavy outflows from Fidelity’s FBTC (-$230.1m) alongside redemptions in Bitwise’s BITB (-$44.3m) and ARK’s ARKB (-$34.5m). Tuesday (Dec. 16) remained negative at -$277.2m, led by BlackRock’s IBIT (-$210.7m) and further selling in BITB (-$50.9m) and ARKB (-$16.9m). Midweek, the strongest day was Wednesday (Dec. 17) at +$457.3m as FBTC (+$391.5m) and IBIT (+$111.2m) outweighed modest outflows in ARKB (-$37.0m). Thursday (Dec. 18) slipped back to -$161.3m with FBTC (-$170.3m) the main drag despite small inflows to IBIT (+$32.8m). Overall, flows were volatile, with one major inflow day unable to fully offset large early-week redemptions.

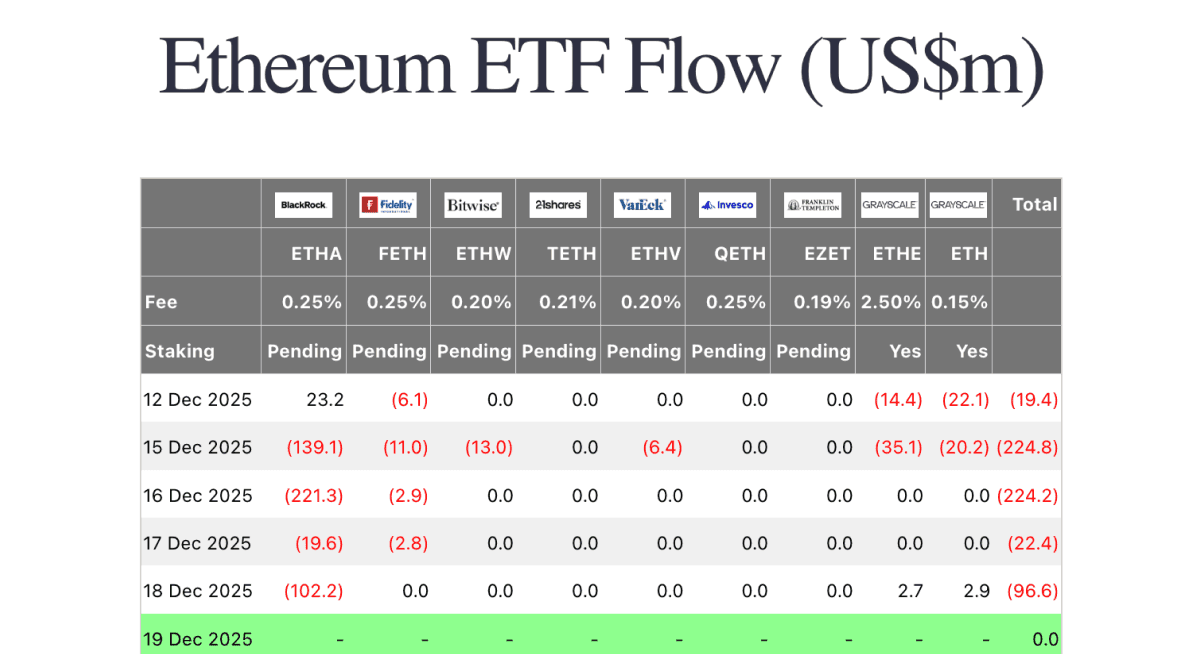

Ethereum ETF Flows

Monday (Dec. 15) opened with ethereum ETFs at -$224.8m, led by BlackRock’s ETHA (-$139.1m) and sizable outflows from Grayscale’s ETHE (-$35.1m) and Grayscale’s ETH (-$20.2m). Tuesday (Dec. 16) was similarly weak at -$224.2m, almost entirely driven by ETHA (-$221.3m) plus smaller redemptions in Fidelity’s FETH (-$2.9m). Midweek, the least-bad day was Wednesday (Dec. 17) at -$22.4m, with losses concentrated in ETHA (-$19.6m) and FETH (-$2.8m). Thursday (Dec. 18) deteriorated again to -$96.6m as ETHA (-$102.2m) outflows were only partially offset by modest inflows to ETHE (+$2.7m) and ETH (+$2.9m). Overall, the week was defined by persistent ETHA-driven redemptions and consistently negative totals.

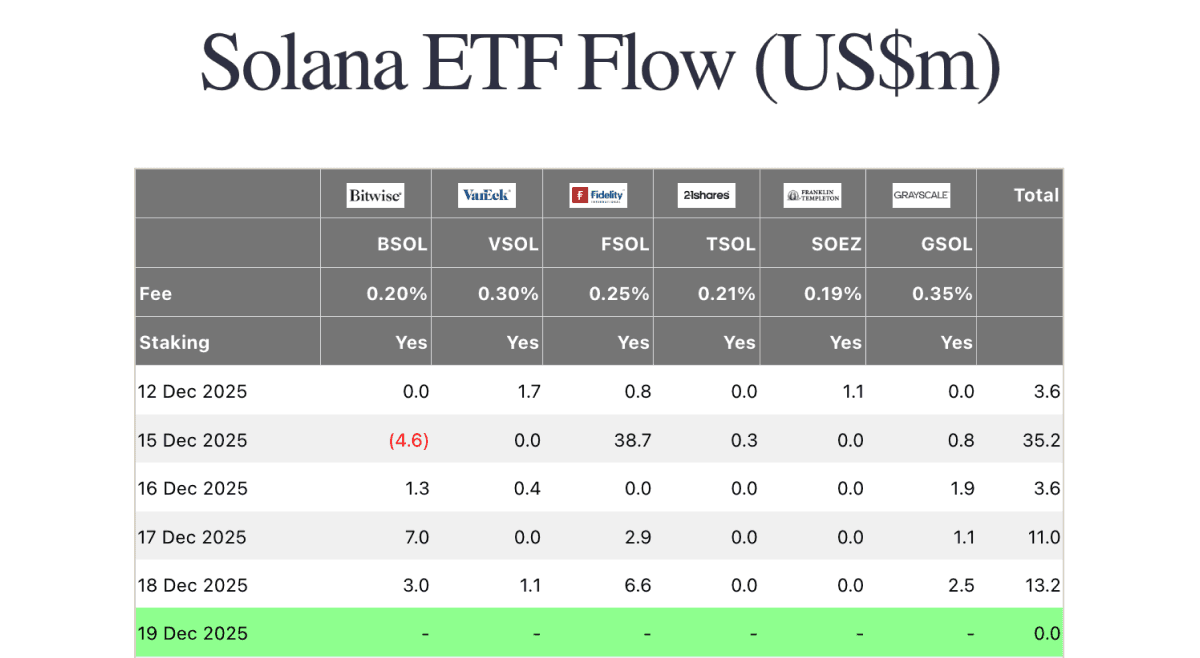

Solana ETF Flows

Monday (Dec. 15) saw Solana ETFs post a net +$35.2m, led by Fidelity’s FSOL (+$38.7m) while Bitwise’s BSOL recorded a -$4.6m outflow. Tuesday (Dec. 16) cooled to +$3.6m, supported by inflows into Grayscale’s GSOL (+$1.9m) and BSOL (+$1.3m) with smaller adds to VanEck’s VSOL (+$0.4m). Midweek, the strongest day was Thursday (Dec. 18) at +$13.2m as FSOL (+$6.6m) and BSOL (+$3.0m) led, supported by GSOL (+$2.5m) and VSOL (+$1.1m). Wednesday (Dec. 17) also remained constructive at +$11.0m, again led by BSOL (+$7.0m). Overall, SOL flows stayed positive through the week, suggesting steadier demand even as broader risk sentiment remained cautious.

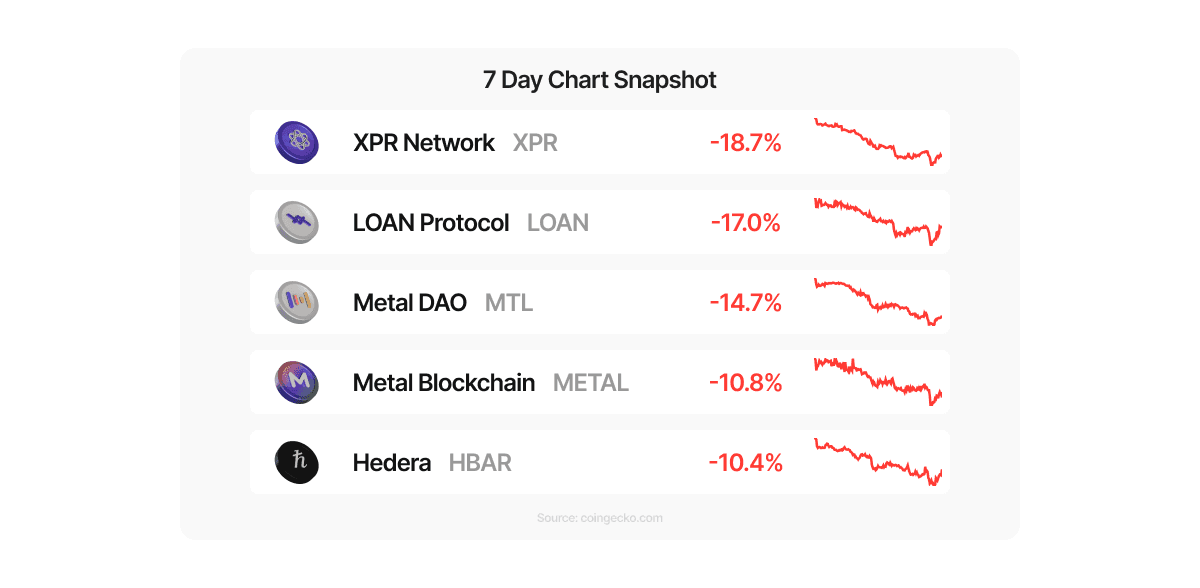

Biggest Movers (Coins Available on Metal Pay)

Selling pressure intensified across these coins over the past seven days, making them the sharpest downside movers on Metal Pay during the broader market pullback. XPR Network (XPR) led declines at -18.7%, followed closely by LOAN Protocol (LOAN) (-17.0%) and Metal DAO (MTL) (-14.7%), as smaller-cap and ecosystem-linked tokens saw outsized moves amid risk-off sentiment. Metal Blockchain (METAL) (-10.8%) and Hedera (HBAR) (-10.4%) also retraced meaningfully as liquidity thinned across altcoins. Historically, clusters of steep weekly drawdowns often coincide with elevated fear readings and forced de-risking, conditions that some investors view as potential entry points once volatility stabilizes and broader sentiment begins to recover.

That’s it for Crypto News in 2025. Thank you to everyone who joins us each Friday to track the markets. From the entire Metal Pay team, we hope you enjoy the holiday season and return in 2026 refreshed and ready for the year ahead.