Dec 12, 2025

Five crypto firms move closer to becoming U.S. banks

Five major crypto firms, including Ripple, Circle and Fidelity Digital Assets, have taken concrete steps toward obtaining U.S. banking charters, signaling deeper integration between the digital asset sector and traditional finance. According to regulatory filings, the applications would allow these firms to offer custody, payments and settlement services directly under federal banking supervision. Supporters argue the move could strengthen consumer protections and bring crypto activity further onshore, while critics warn it may blur lines between banking and higher-risk digital asset businesses. The applications come as U.S. regulators face growing pressure to clarify how crypto firms can operate within existing financial frameworks. Approval would mark a significant shift in how crypto companies interact with the regulated banking system.

CFTC clears path for spot crypto on regulated exchanges

U.S. spot crypto products are set to begin trading on CFTC-registered exchanges for the first time, marking a notable expansion of regulated market access beyond derivatives. The move is framed by the agency as a customer-protection upgrade, positioning U.S. venues as an alternative to offshore exchanges after recent incidents abroad. The announcement also fits into a broader U.S. policy push to bring crypto activity onshore with clearer rules and supervision. Market participants will be watching which contracts list first, how liquidity develops, and whether other regulated venues follow with competing offerings.

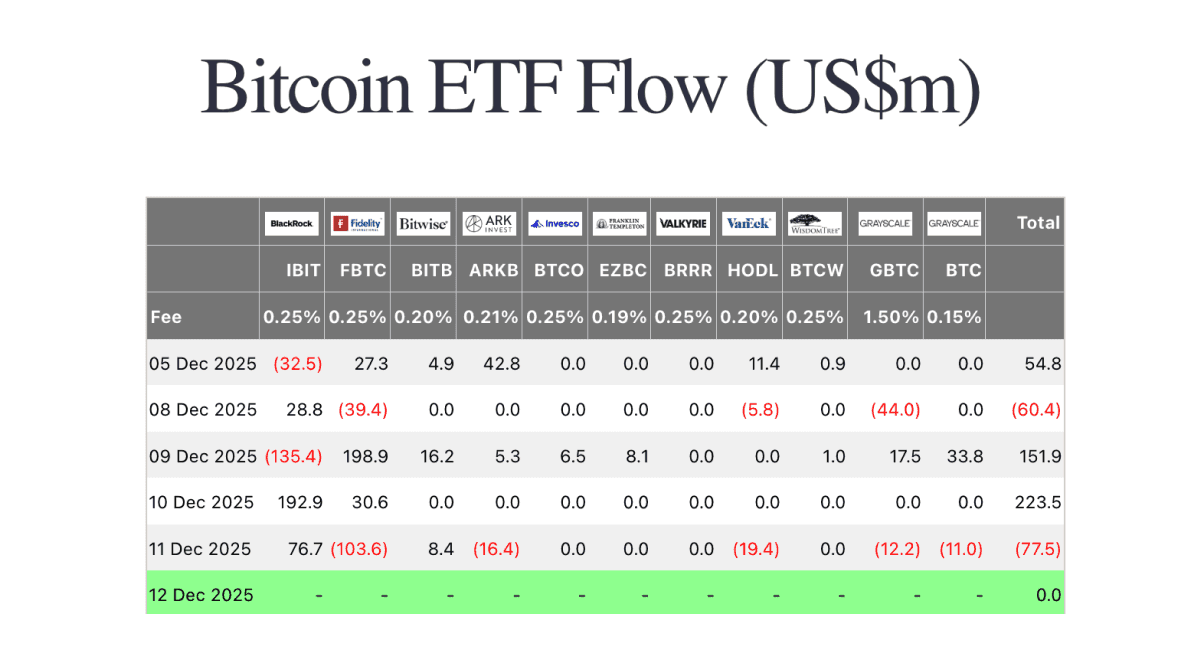

Bitcoin ETF Flows

Monday (Dec 8) saw bitcoin ETFs log $60.4m of net outflows, with selling led by Grayscale’s GBTC (-$44.0m) and Fidelity’s FBTC (-$39.4m), partly offset by BlackRock’s IBIT (+$28.8m). Tuesday (Dec 9) flipped back to $151.9m of net inflows, driven by FBTC (+$198.9m) and additional support from Grayscale’s BTC (+$33.8m) and GBTC (+$17.5m), even as IBIT posted -$135.4m. The strongest midweek day was Wednesday (Dec 10) with $223.5m of inflows, led by IBIT (+$192.9m) alongside FBTC (+$30.6m). Thursday (Dec 11) was the weakest session at $77.5m of net outflows, with redemptions led by FBTC (-$103.6m) and HODL (-$19.4m) despite IBIT (+$76.7m).

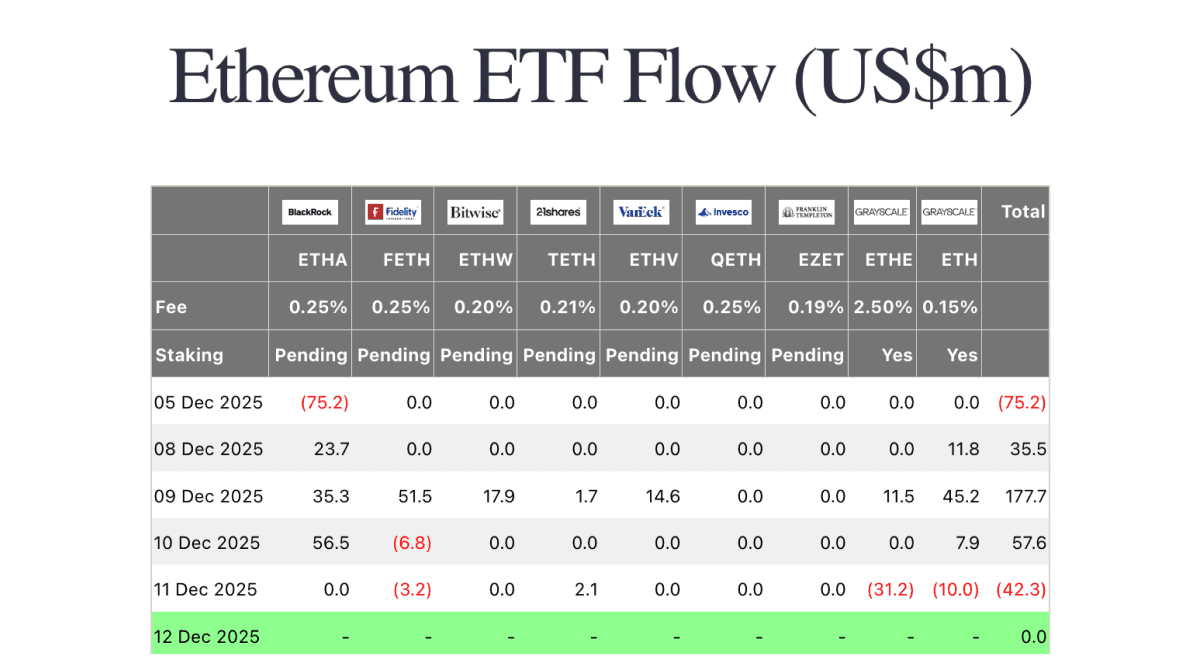

Ethereum ETF Flows

Monday (Dec 8) opened with $35.5m of net inflows, led by BlackRock’s ETHA (+$23.7m) and Grayscale’s ETH (+$11.8m). Tuesday (Dec 9) strengthened sharply to $177.7m of inflows, paced by Fidelity’s FETH (+$51.5m), ETHA (+$35.3m) and Grayscale’s ETH (+$45.2m), with smaller adds across several other products. The strongest midweek day was Wednesday (Dec 10) at $57.6m of inflows, driven almost entirely by ETHA (+$56.5m) even as FETH showed -$6.8m. Thursday (Dec 11) reversed to $42.3m of net outflows, led by Grayscale’s ETHE (-$31.2m) and Grayscale’s ETH (-$10.0m), partially offset by 21Shares’ TETH (+$2.1m).

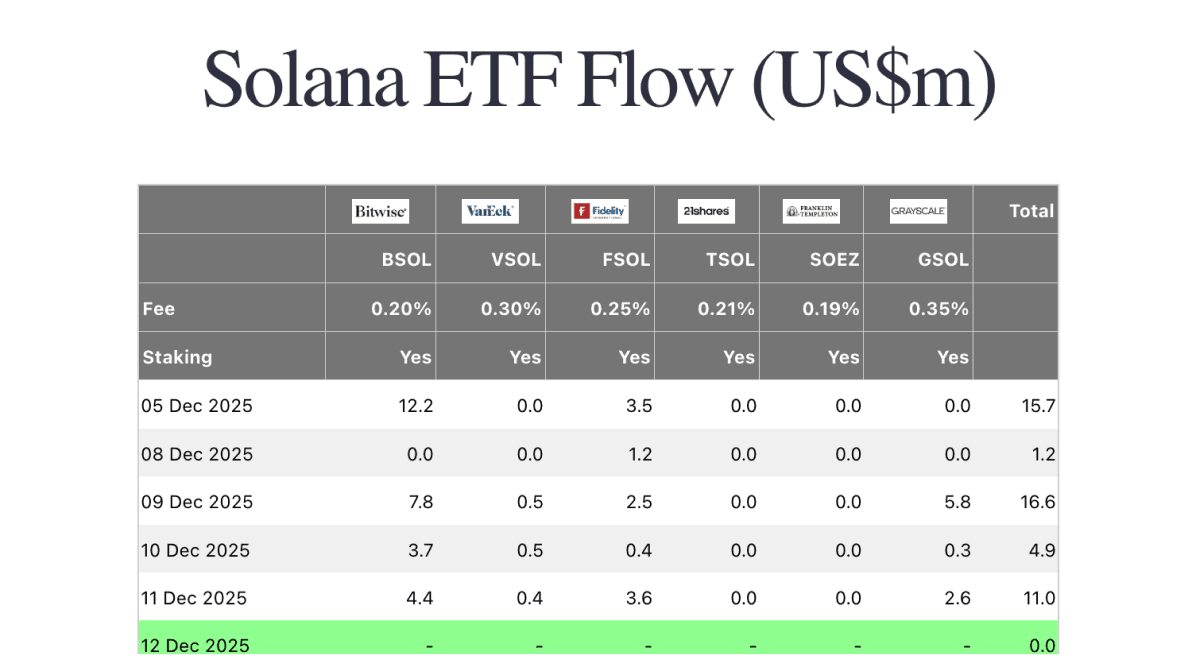

Solana ETF Flows

Monday (Dec 8) saw Solana ETFs post a modest $1.2m net inflow, coming entirely from Fidelity’s FSOL (+$1.2m). Tuesday (Dec 9) improved to $16.6m of inflows, led by Bitwise’s BSOL (+$7.8m) and Grayscale’s GSOL (+$5.8m), with smaller contributions from FSOL (+$2.5m) and VanEck’s VSOL (+$0.5m). The strongest midweek day was Thursday (Dec 11) with $11.0m of inflows, supported by BSOL (+$4.4m), FSOL (+$3.6m) and GSOL (+$2.6m). Wednesday (Dec 10) was the weakest midweek session at $4.9m, still positive, led by BSOL (+$3.7m) with small adds elsewhere.

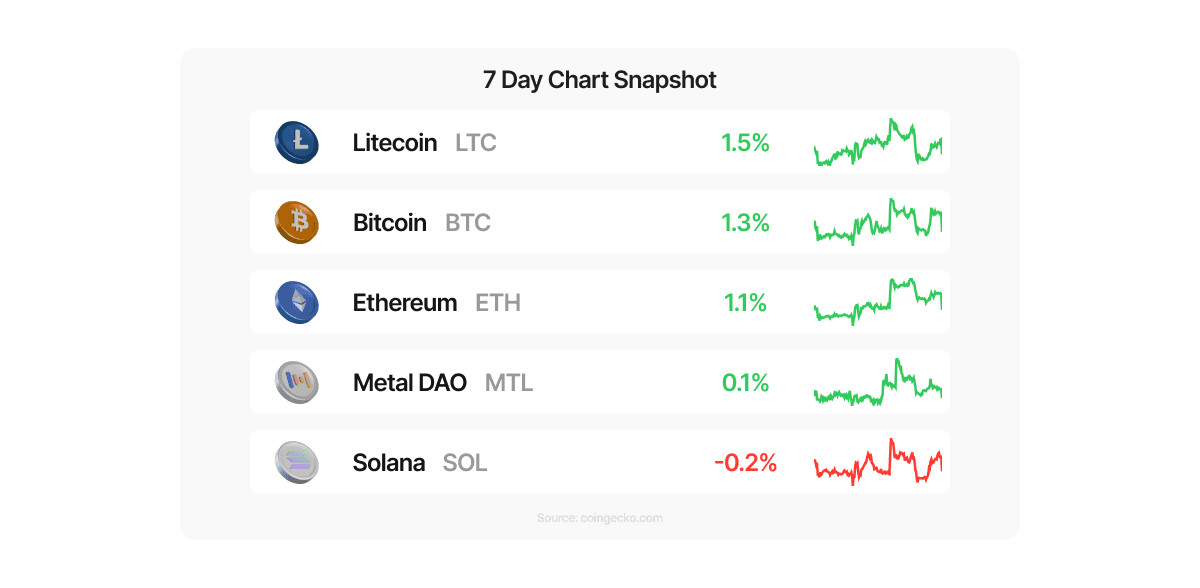

7 Day Snapshot - Coins Available on Metal Pay

Litecoin (LTC) led Metal Pay’s tracked names over the past 7 days, edging higher while most majors were flat to slightly higher. Bitcoin (BTC) and Ethereum (ETH) also posted small gains, suggesting the week was more about stabilization than a broad risk-on rebound. Metal DAO (MTL) held roughly flat over the 7 days, while Solana (SOL) was the lone laggard, slipping slightly. With moves this small, price action likely reflects macro risk appetite and positioning more than any single catalyst, with investors rotating defensively into large, liquid tokens.