Jan 10, 2026

Morgan Stanley files for bitcoin and solana ETFs

Morgan Stanley filed with the SEC to launch ETFs tied to bitcoin and solana prices, a notable step by a major U.S. bank deeper into regulated crypto exposure. The move signals that large financial institutions are increasingly comfortable packaging crypto beta into familiar ETF wrappers rather than pushing clients to hold tokens directly. Reuters noted the filing arrives amid a more permissive U.S. stance toward bank participation in crypto activity and continued investor demand for exchange-traded access. If approved, these products would broaden mainstream on-ramps and add another channel for institutional flows. It also underscores how quickly crypto has shifted from “alternative” to a competitive battleground for traditional asset managers and banks.

Trump-linked World Liberty seeks national trust bank charter

World Liberty Financial, a crypto venture backed by the Trump family, said a subsidiary applied to the OCC to create a national trust bank focused on stablecoin issuance/redemption and digital asset custody. Reuters reported the effort is centered on USD1, the firm’s dollar-backed stablecoin, and is framed as aligning with the GENIUS Act’s stablecoin regime. A trust bank charter would move the business closer to a bank-like footprint, potentially improving perceived safety for users and counterparties relative to less regulated issuers. The application also highlights a broader trend: crypto companies increasingly want bank-grade status to access payments rails, custody credibility, and clearer supervisory pathways. For consumers, it’s another sign that stablecoins are converging toward regulated financial infrastructure rather than remaining a purely crypto-native product.

Truebit token crashes after exploit drains 8,535 ETH

Truebit’s TRU token plunged 99.9% after an exploit reportedly allowed an attacker to extract 8,535 ETH (about $26.6 million) by abusing a flaw in an older smart contract. CoinDesk reported the attacker could acquire TRU at effectively no cost and sell it back to siphon ether, triggering a rapid collapse in TRU’s price and renewed scrutiny of legacy contract risk. The incident is a reminder that smart-contract exposure can persist long after a project’s “active” development phase, especially where older code remains deployed and reachable. For everyday users, the practical takeaway is that token risk is not only about market volatility, technical and operational risk can be just as decisive. It also reinforces why audited upgrades, clear contract deprecation, and conservative permissions matter for any on-chain product that touches user funds.

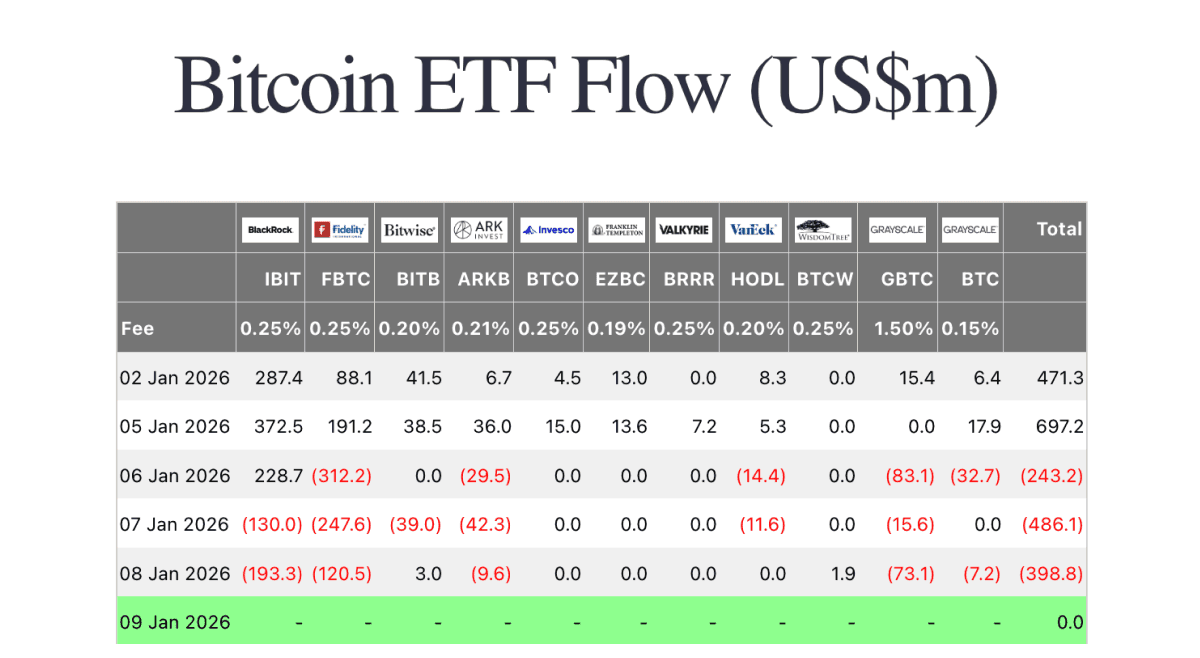

Bitcoin ETF Flows

On Monday, spot Bitcoin ETFs took in $697.2m, led by BlackRock’s IBIT (+$372.5m) and Fidelity’s FBTC (+$191.2m). Tuesday flipped to a $243.2m net outflow as large redemptions at FBTC (−$312.2m) and Grayscale’s GBTC (−$83.1m) outweighed IBIT’s +$228.7m. The weakest midweek print was Wednesday at −$486.1m, driven again by IBIT (−$130.0m) and FBTC (−$247.6m), with broad softness across ARKB and BITB as well. Outflows stayed heavy Thursday at −$398.8m, with IBIT (−$193.3m) and FBTC (−$120.5m) leading, partially offset by small inflows to BITB (+$3.0m) and BTCW (+$1.9m). Overall, the week opened with strong demand but ended dominated by three straight sessions of net redemptions, leaving flows roughly flat-to-slightly positive across the full window shown. It will be interesting to see how markets close the week today.

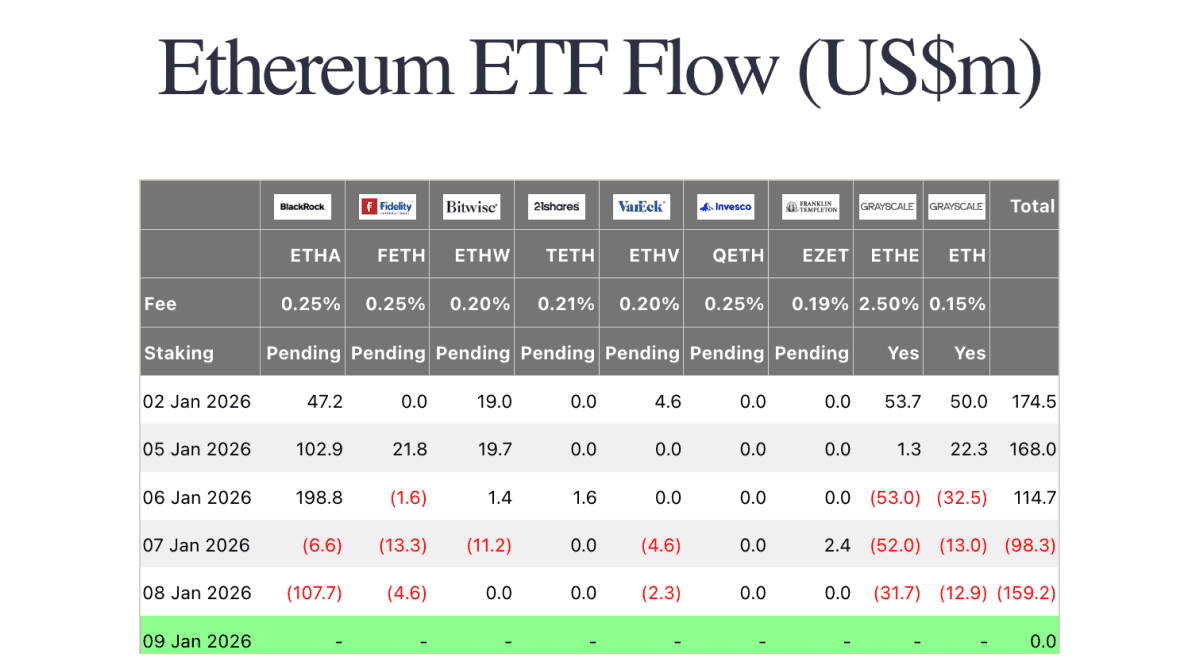

Ethereum ETF Flows

On Monday, spot Ethereum ETFs brought in $168.0m, led by BlackRock’s ETHA (+$102.9m) with support from Fidelity’s FETH (+$21.8m) and Grayscale’s ETH (+$22.3m). Tuesday remained positive at +$114.7m, but flows were more mixed as ETHA (+$198.8m) offset sizeable outflows from Grayscale’s ETHE (−$53.0m) and ETH (−$32.5m). The strongest/weakest midweek swing came as Wednesday turned to −$98.3m, led by ETHE (−$52.0m) with additional redemptions across FETH and ETHW. Outflows accelerated Thursday to −$159.2m, driven primarily by ETHA (−$107.7m) alongside ETHE (−$31.7m) and ETH (−$12.9m). Overall, ETH ETF flows stayed net positive for the broader window shown thanks to large ETHA creations early in the week, even as Grayscale products saw consistent pressure into the back half.

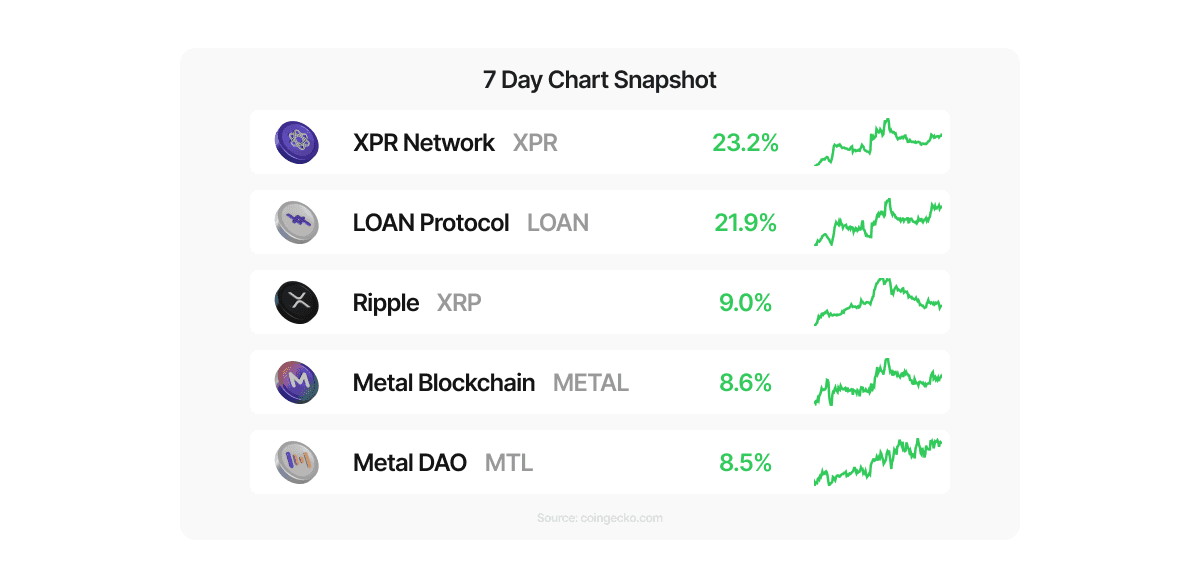

Top Movers (Coins Available on Metal Pay - 7 Day Chart)

XPR Network (XPR) led the pack this week, up +23.2%, with LOAN Protocol (LOAN) close behind at +21.9% as smaller-cap names outperformed during a choppy macro-driven tape. Ripple (XRP) still posted a solid +9.0% week, extending its early-2026 momentum as investors continue to focus on product-driven demand and broader market narratives around XRP investment vehicles. Metal Blockchain (METAL) gained +8.6% and Metal DAO (MTL) rose +8.5%, tracking the broader rotation into altcoins that showed relative strength even as ETF flows turned volatile midweek.

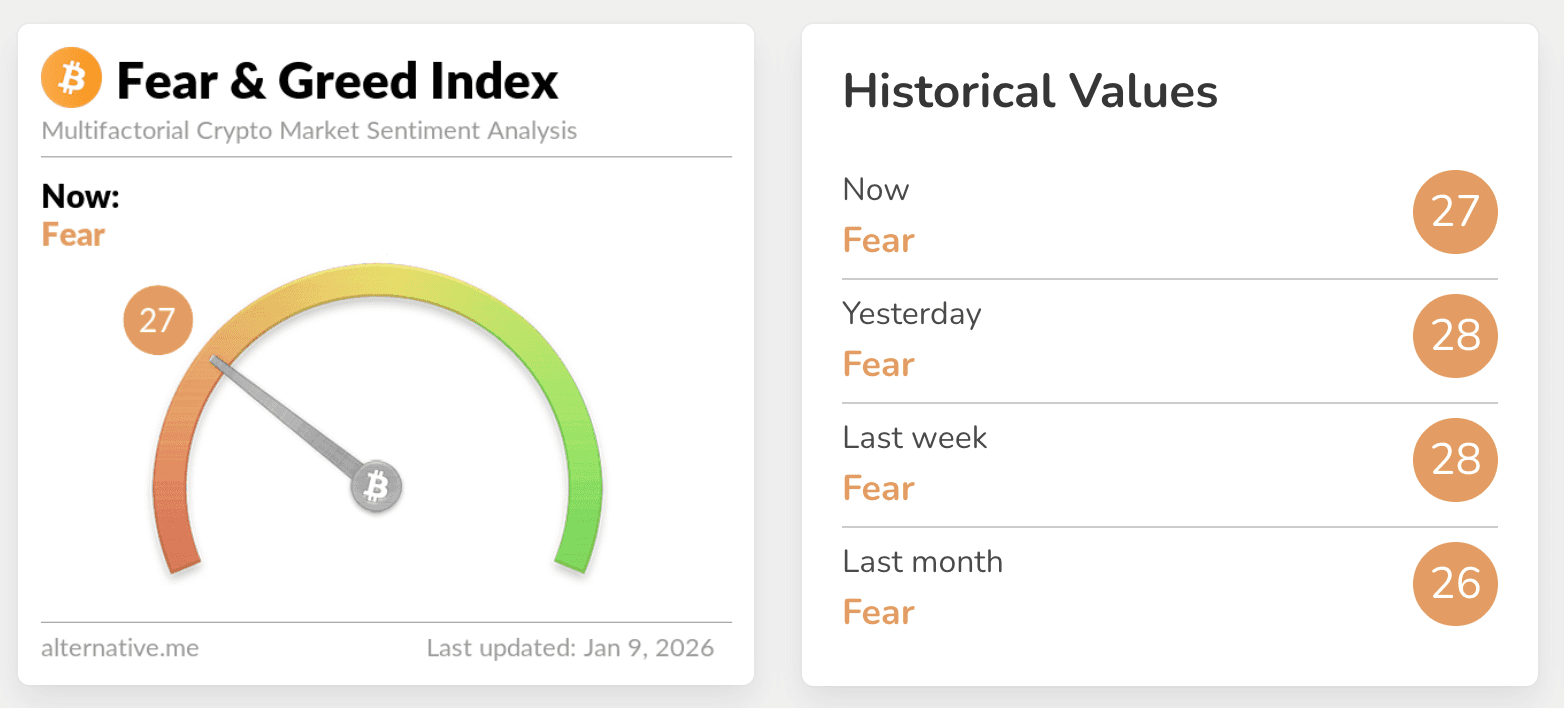

Sentiment remains cautious: the Crypto Fear & Greed Index finished the week at 27 (“Fear”), roughly unchanged from last week’s 28, suggesting risk appetite is improving only gradually.