Feb 6, 2026

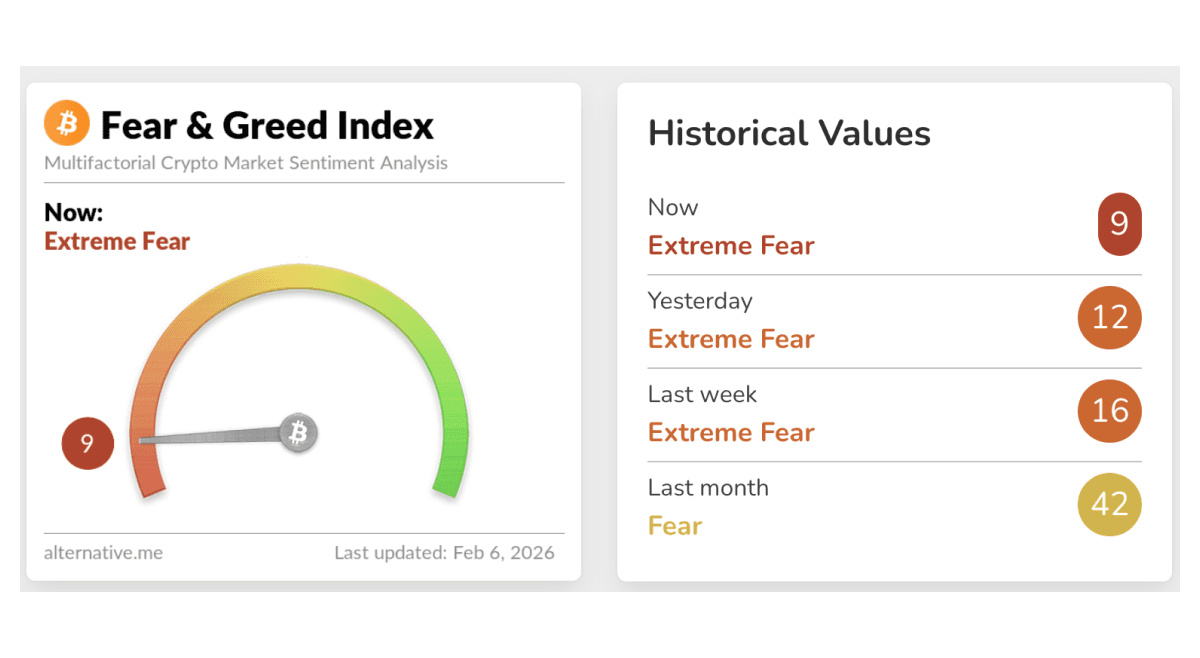

Crypto markets suffered a broad and aggressive selloff this week, with major assets posting their steepest losses since late 2022 as investors moved decisively into risk-off mode. Bitcoin fell nearly 18% over seven days, while Ethereum and Solana each dropped close to 28%, pressured by a combination of macro uncertainty, heavy liquidations, and sustained ETF outflows. Reuters and CoinDesk reported that U.S. spot Bitcoin ETFs saw renewed net redemptions, removing a key source of institutional support just as prices broke below critical technical levels. Analysts also pointed to forced unwinds of leveraged positions, which accelerated downside momentum once support zones failed. The pullback pushed the Crypto Fear & Greed Index into “Extreme Fear,” highlighting a sharp reset in sentiment as traders step back to reassess positioning amid heightened volatility.

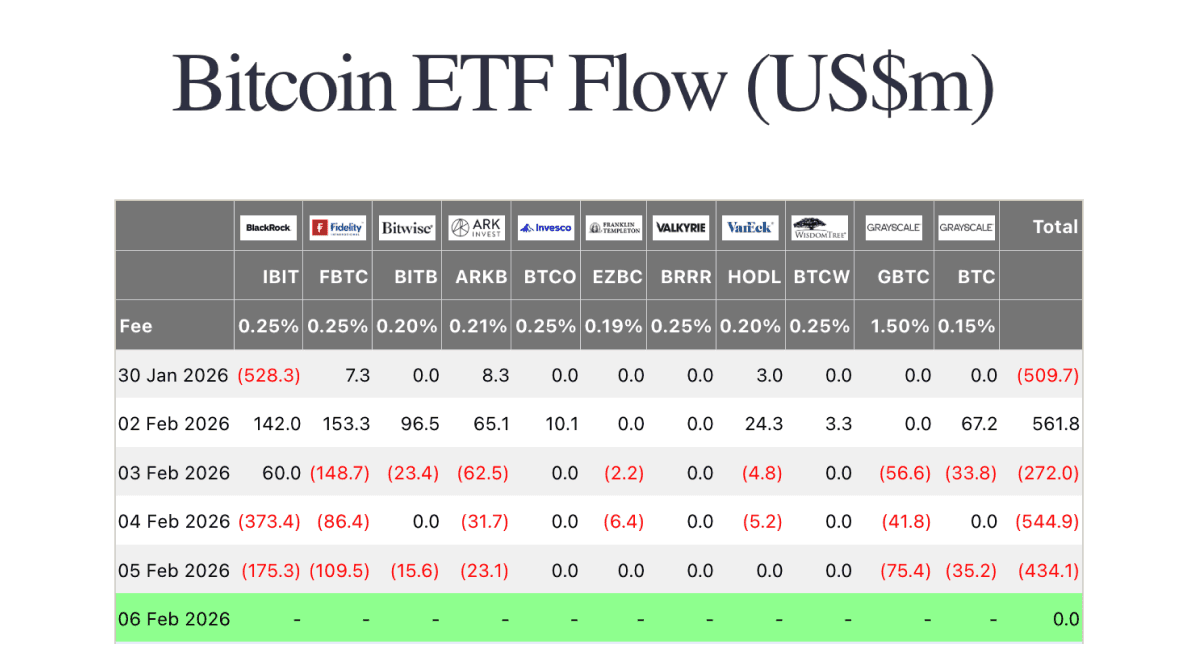

Bitcoin ETF Outflows Accelerate as Institutional Demand Cools

U.S.-listed spot Bitcoin ETFs recorded renewed and sustained net outflows this week, reinforcing the downside pressure already weighing on crypto markets. CoinDesk reported that multiple sessions saw hundreds of millions of dollars exit major funds, led by redemptions from Fidelity’s FBTC and Grayscale’s GBTC, while even BlackRock’s IBIT showed intermittent weakness. Analysts noted that fading ETF inflows remove a key structural support that had underpinned Bitcoin’s rally through late 2025. With institutional demand cooling and retail sentiment sliding into extreme fear, the absence of steady ETF buying has made recent price declines sharper and more persistent. The shift suggests markets may need time to stabilize before longer-term buyers re-engage.

Notably, the selloff coincided with record trading activity in BlackRock’s spot Bitcoin ETF. IBIT recorded more than $10 billion in single-day trading volume, its highest level since launch, as bitcoin prices fell sharply. Analysts said the surge reflected intense institutional repositioning rather than fresh inflows, highlighting how heavy two-way trading and hedging activity can rise even as net flows turn negative. The spike in volume underscored elevated volatility and suggested large investors were actively adjusting exposure during the downturn, rather than stepping away from the market entirely.

BitcoinVM on Metal Blockchain, Expanding Bitcoin Programmability

Metal Blockchain announced the launch of BitcoinVM, a new execution environment designed to bring Bitcoin-style programmability and smart contract functionality onto the Metal ecosystem. According to the Metal Blockchain team, BitcoinVM enables developers to deploy Bitcoin-compatible logic while benefiting from faster settlement, lower fees, and Metal’s compliance-friendly infrastructure. The release is aimed at expanding Bitcoin’s utility beyond simple transfers, supporting use cases such as decentralized finance, tokenized assets, and programmable payments. The move comes as broader crypto markets face volatility, highlighting continued development at the infrastructure layer despite near-term price pressure. Metal said BitcoinVM is part of its longer-term strategy to bridge Bitcoin security with scalable, application-ready blockchain rails.

Bitcoin ETF Flows

Monday saw a sharp rebound with $561.8m of net inflows, led by Fidelity’s FBTC (+$153.3m) and BlackRock’s IBIT (+$142.0m), alongside gains in Bitwise’s BITB (+$96.5m) and ARK’s ARKB (+$65.1m). Tuesday flipped back to $272.0m of net outflows as FBTC (-$148.7m) and ARKB (-$62.5m) led the selling, with GBTC (-$56.6m) also dragging despite IBIT posting a $60.0m inflow. Midweek was weakest on Wednesday with $544.9m of net outflows, driven primarily by IBIT (-$373.4m) and continued redemptions in FBTC (-$86.4m) and GBTC (-$41.8m). Thursday remained negative at $434.1m of net outflows, and last Friday (Jan. 30) also logged a $509.7m outflow led by IBIT (-$528.3m). Overall, flows were volatile and tilted decisively risk-off after Monday’s brief reset.

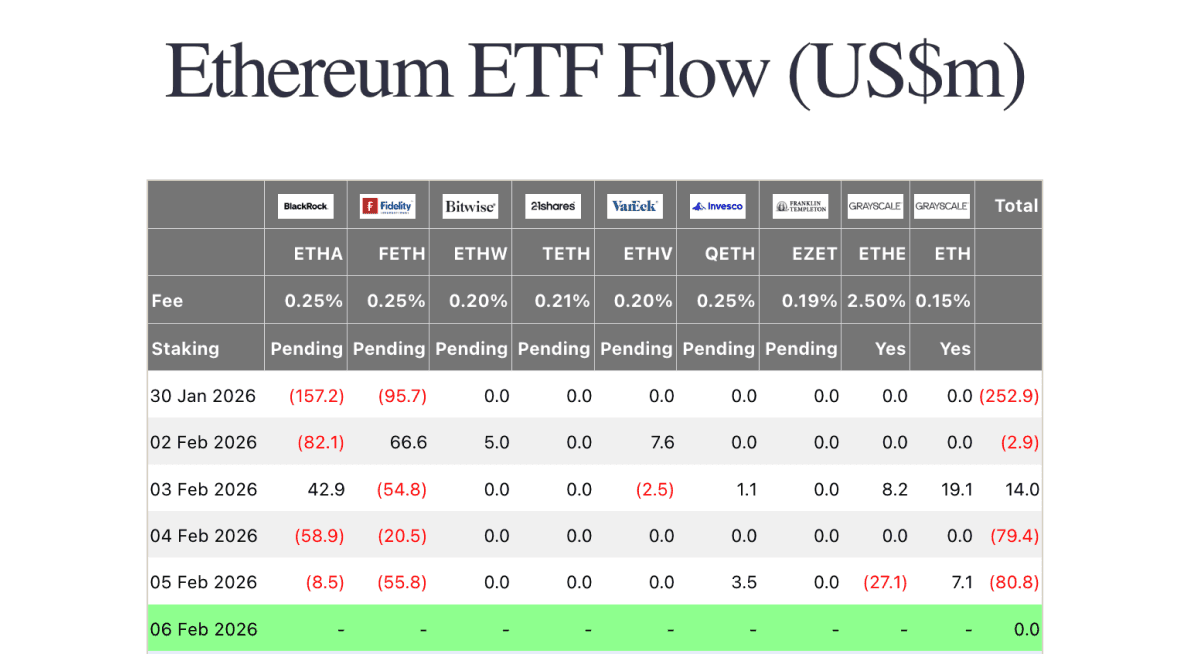

Ethereum ETF Flows

Monday was effectively flat with a small $2.9m net outflow, as BlackRock’s ETHA (-$82.1m) was mostly offset by Fidelity’s FETH (+$66.6m) plus smaller inflows in Bitwise’s ETHW (+$5.0m) and VanEck’s ETHV (+$7.6m). Tuesday improved to $14.0m of net inflows, helped by ETHA (+$42.9m) and Grayscale’s ETH (+$19.1m), even as FETH (-$54.8m) pulled back. Midweek was weakest on Wednesday with $79.4m of net outflows, led by ETHA (-$58.9m) and FETH (-$20.5m). Thursday stayed soft at $80.8m of net outflows as FETH (-$55.8m) and Grayscale’s ETHE (-$27.1m) outweighed modest positives in ETH (+$7.1m) and Invesco’s QETH (+$3.5m). Overall, ETH ETF flows tracked the broader risk-off tone, with only a brief positive pocket on Tuesday.

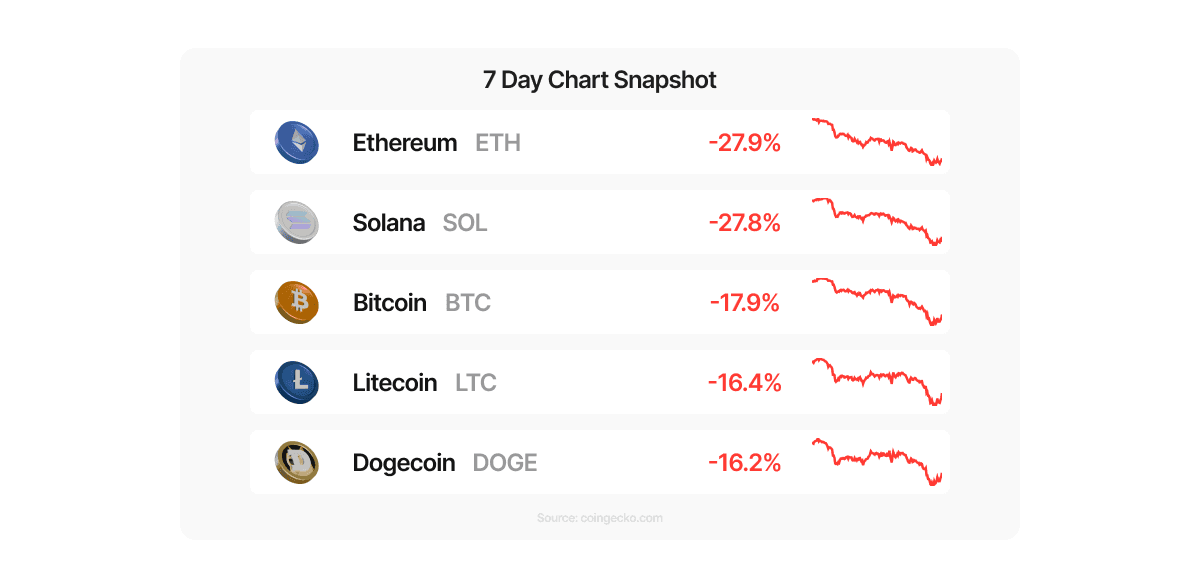

Top Movers (Coins Available on Metal Pay - 7 Day Chart)

This week’s top movers were defined by downside, with even major assets seeing sharp weekly drawdowns amid ETF outflows and extreme fear. Ethereum (ETH) and Solana (SOL) led losses at nearly 28% each, reflecting how high-beta smart-contract platforms tend to amplify selloffs during risk-off periods. Bitcoin (BTC) held up comparatively better with a 17.9% decline, while Litecoin (LTC) and Dogecoin (DOGE) were the most resilient among majors, each falling roughly 16%. Overall, the list highlights where selling pressure was most concentrated rather than outright strength.

At the time of writing, some altcoins were showing sharp short-term rebounds following the selloff. XRP led 24-hour movers with gains of around 18%, while Hedera (HBAR) rose roughly 11.7%, suggesting opportunistic buying and short covering as traders reacted to extreme fear conditions. These moves came after heavy losses earlier in the week and appeared driven more by volatility and positioning resets than a broader shift in market trend.