Jan 30, 2026

Crypto News - 30 January 2026 - Crypto Slides as Fed Chair Speculation Hits Risk Appetite

Crypto markets fell late this week as investors digested fresh macro uncertainty and a broader risk-off move across equities. Reuters reported bitcoin slid to a two-month low amid rising speculation that former Fed governor Kevin Warsh could be tapped as the next Federal Reserve chair, reviving concerns about tighter liquidity and a smaller Fed balance sheet. Ether also dropped to a two-month low as tech weakness (including a sharp Microsoft decline tied to AI spending concerns) weighed on sentiment. In the background, the Crypto Fear & Greed Index deteriorated further into “Extreme Fear,” underscoring how quickly traders shifted from cautious to defensive. For Metal Pay users, the takeaway is that macro headlines and liquidity expectations are still the dominant driver of weekly price direction.

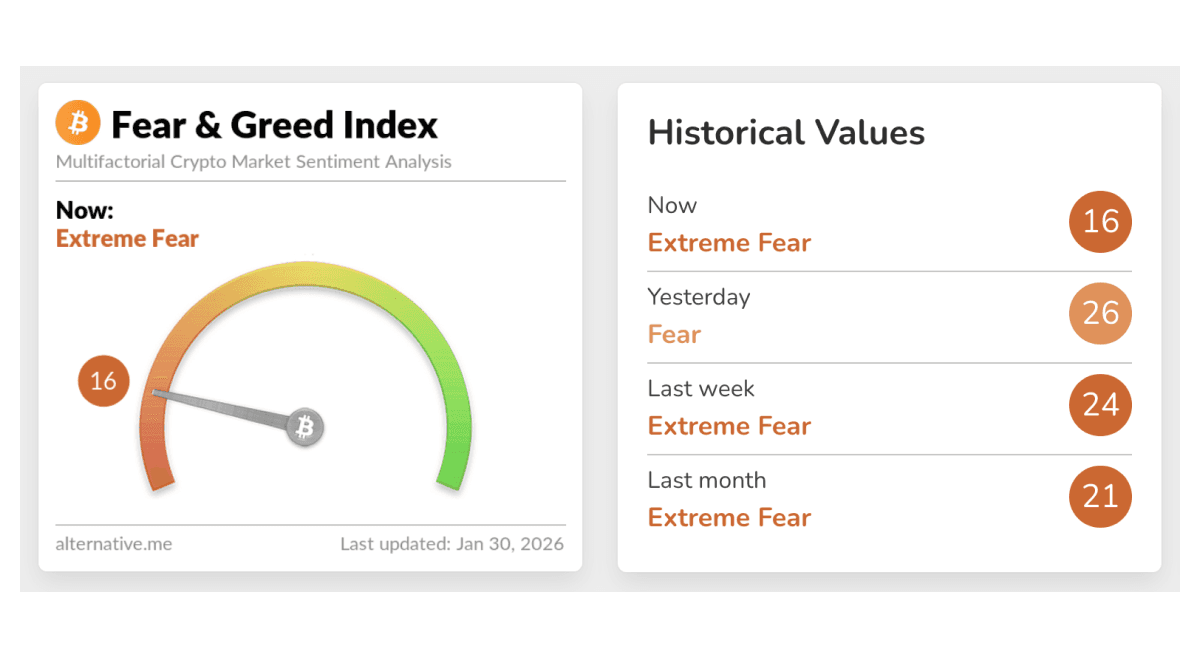

Fear & Greed Index Sinks to Extreme Fear as Volatility Returns

The Crypto Fear & Greed Index fell to 16 (Extreme Fear) as of Jan 30, reflecting a sharp deterioration in market sentiment after a volatile week. The index was higher on the prior day (26, “Fear”), showing how quickly traders repriced risk as prices slid and uncertainty rose. Readings remained deeply negative versus last week and last month, reinforcing that fear has dominated the tape rather than “buy the dip” confidence. In practical terms, this kind of sentiment regime often coincides with wider spreads, faster liquidations, and heightened sensitivity to macro headlines. For everyday users, it’s a reminder that weekly moves can be driven as much by positioning and emotion as by any single crypto-specific catalyst.

Washington Pushes Crypto Market Rules as Stablecoin Interest Debate Intensifies

U.S. lawmakers and regulators moved closer to a federal crypto market-structure framework this week, but key disputes remain unresolved. Reuters reported the Senate Agriculture Committee advanced a crypto bill that would expand the CFTC’s role in spot crypto oversight, yet the vote was strictly along party lines, signaling a tough path to bipartisan passage. A major sticking point is whether crypto firms should be allowed to offer interest or other returns on stablecoin holdings, an issue banks argue could accelerate deposit outflows. The White House also convened (or prepared to convene) a meeting with banking and crypto leaders to broker compromises on the legislation’s most contentious provisions. For Metal Pay’s audience, the most immediate relevance is stablecoin policy: rules around yields, custody, and permitted activities could shape what products U.S. consumers can access through compliant apps.

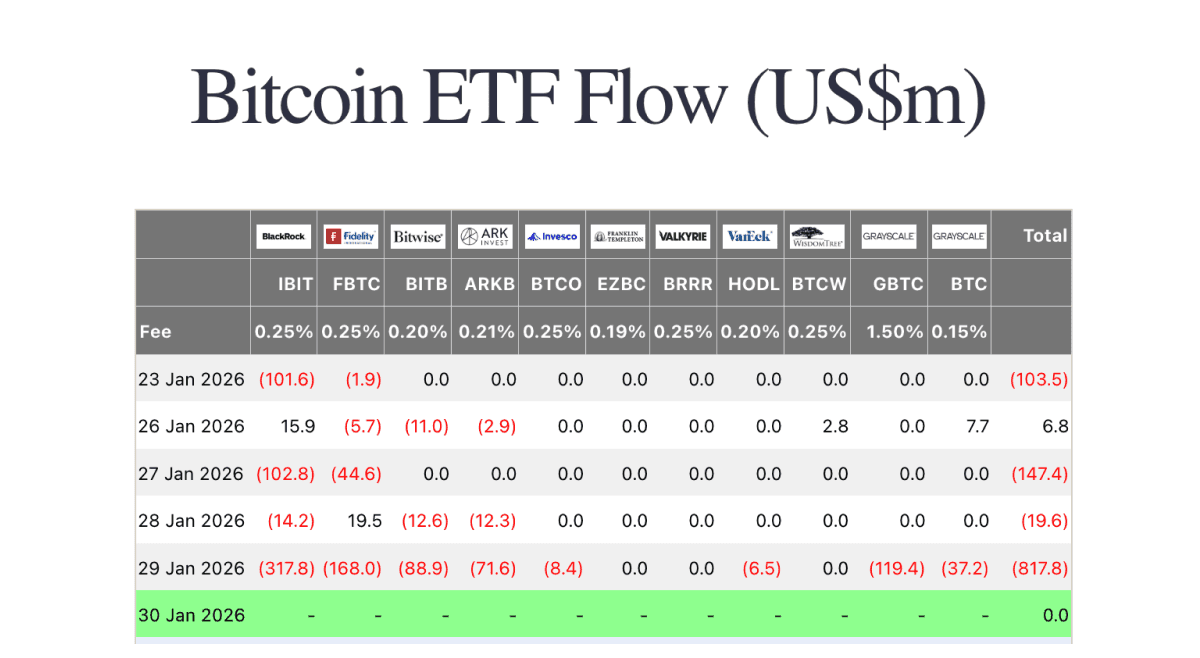

Bitcoin ETF Flows

Monday saw a modest net inflow of $6.8m, led by BlackRock’s IBIT (+$15.9m) with support from Grayscale’s BTC (+$7.7m), while Fidelity’s FBTC (-$5.7m) and Bitwise’s BITB (-$11.0m) offset part of the demand. Tuesday flipped decisively negative with $147.4m of net outflows, driven by IBIT (-$102.8m) and FBTC (-$44.6m). Midweek, Wednesday remained soft at -$19.6m as Fidelity’s FBTC (+$19.5m) wasn’t enough to counter outflows from IBIT (-$14.2m), BITB (-$12.6m) and ARKB (-$12.3m). The heaviest selling hit on Thursday with $817.8m of net redemptions, led by IBIT (-$317.8m), FBTC (-$168.0m) and GBTC (-$119.4m). Overall, the week featured persistent institutional de-risking, culminating in a large Thursday outflow that mirrored the broader risk-off move in crypto prices.

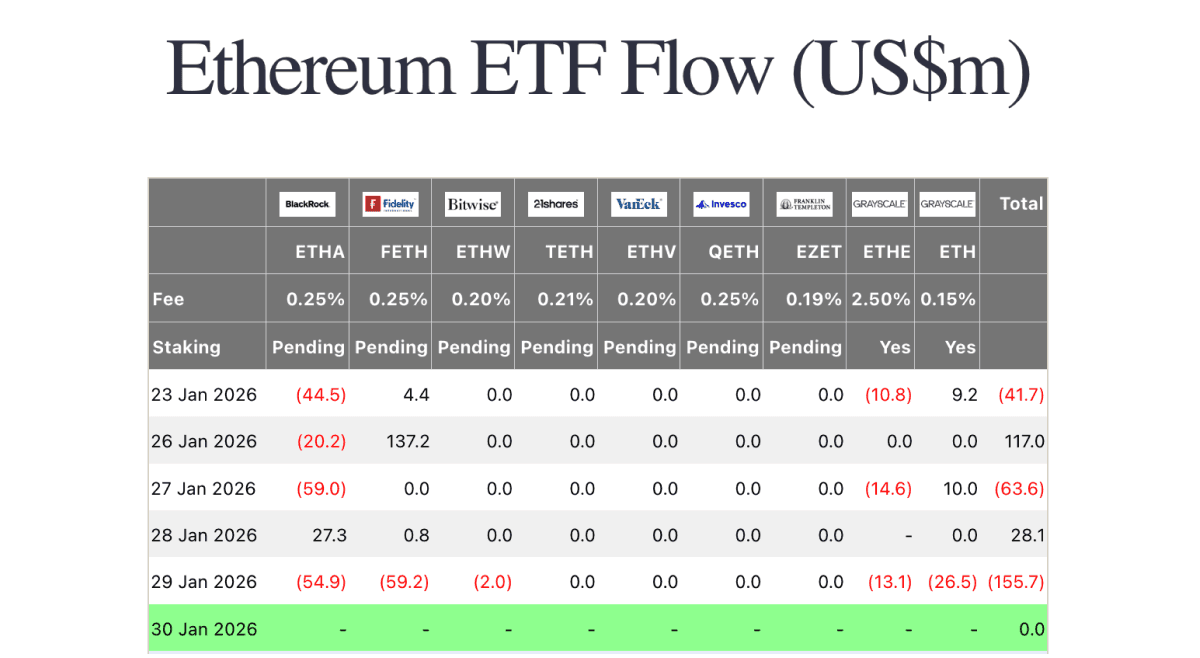

Ethereum ETF Flows

Monday posted a strong net inflow of $117.0m, dominated by Fidelity’s FETH (+$137.2m) while BlackRock’s ETHA saw outflows (-$20.2m). Tuesday reversed to $63.6m of net outflows as ETHA (-$59.0m) and Grayscale’s ETHE (-$14.6m) outweighed inflows into Grayscale’s ETH (+$10.0m). Midweek improved on Wednesday with a $28.1m net inflow, led by ETHA (+$27.3m) alongside a small positive print for FETH (+$0.8m). The weakest day was Thursday at $155.7m of net outflows, with selling spread across ETHA (-$54.9m), FETH (-$59.2m), ETHE (-$13.1m) and ETH (-$26.5m). Overall, ETH ETF flows swung sharply day to day, but ended the week tilted negative as risk appetite cooled and outflows accelerated into Thursday.

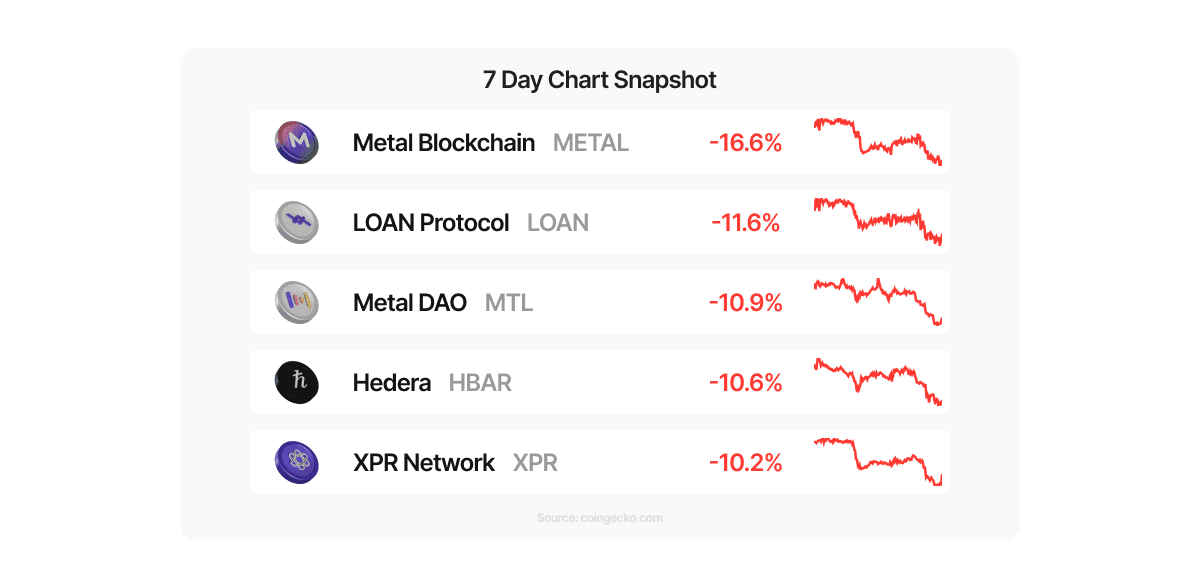

Top Movers (Coins Available on Metal Pay - 7 Day Chart)

This week’s “biggest movers” list was dominated by downside, highlighting the tokens that dropped the most on our tracked tokens during the broader market pullback. Metal Blockchain (METAL) led the declines at -16.6% over 7 days, with LOAN Protocol (-11.6%) and Metal DAO (MTL) close behind as smaller-cap names typically saw amplified volatility. Hedera (HBAR) and XPR Network (XPR) also slid around the -10% range, reflecting how the risk-off tone hit both majors and ecosystem tokens alike. The macro-driven selloff and worsening sentiment (fear readings) were the main backdrop, rather than token-specific catalysts, so the move looked more like correlated de-risking than isolated project news.

Automatic Buys - Build your crypto stack without timing the market.