Jan 23, 2026

Crypto Prices Slide as Tariff Rhetoric Triggers Risk-Off Move

Crypto markets saw a sharp pullback this week as renewed tariff and trade policy discussions pressured global risk assets, spilling into digital assets. Bitcoin and ethereum both declined alongside equities, while some altcoins experienced outsized losses as traders reduced exposure. Analysts cited concerns that broader trade measures could slow global growth and keep financial conditions tighter for longer, weighing on speculative assets. The selloff was reinforced by sustained outflows from U.S. bitcoin and ethereum ETFs, signaling continued caution from institutional investors. By week’s end, sentiment indicators had deteriorated rapidly, underscoring the market’s shift into a defensive posture.

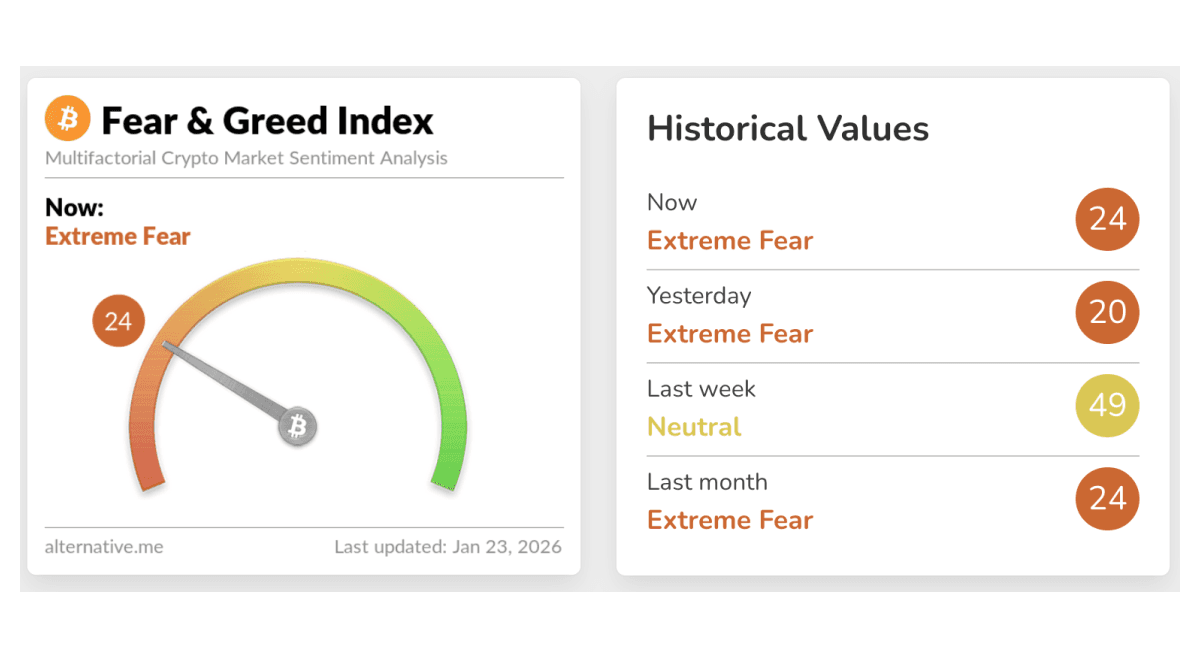

The shift was echoed in sentiment indicators, with the Crypto Fear & Greed Index sliding back into “Extreme Fear” by week’s end as investors pulled back amid heightened macro uncertainty.

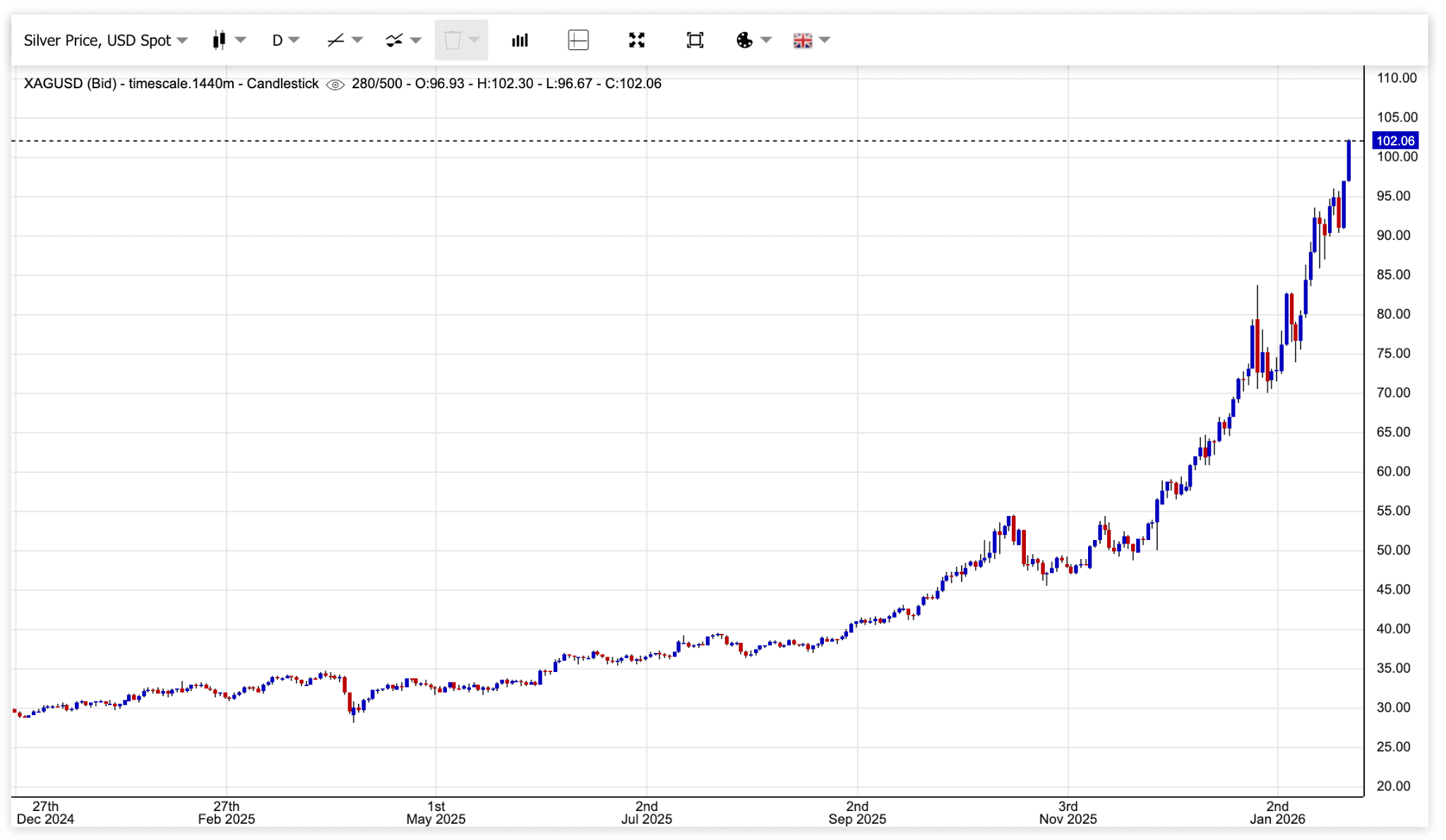

Silver Breaks Above $100 as Crypto Struggles in Risk-Off Week

Silver prices surged above $100 per ounce this week, hitting a fresh record as investors rotated into traditional safe-haven assets amid rising macro uncertainty. Reuters reported the move was driven by a combination of safe-haven demand, strong industrial consumption expectations, and investor hedging as tariff and trade policy tensions resurfaced. The rally in precious metals stood in sharp contrast to crypto markets, where bitcoin, ethereum, and altcoins posted broad declines alongside heavy ETF outflows. The divergence highlights how capital shifted toward hard assets during the risk-off move, even as digital assets failed to attract the same defensive inflows. By week’s end, silver’s breakout underscored the market’s preference for established stores of value during periods of heightened uncertainty.

BitGo IPO Reopens the Crypto Listing Window

Crypto custody firm BitGo debuted on the NYSE this week, a notable milestone for public-market appetite after a quiet stretch for crypto listings. Reuters reported the company opened above its IPO price and briefly implied a multi-billion-dollar valuation, signaling that investors are still willing to back infrastructure businesses with compliance and custody positioning. The listing is being watched as a bellwether for other crypto companies considering the public markets, especially as regulatory tone and risk appetite continue to evolve. For users, it’s another reminder that custody, settlement, and regulated rails remain a core theme of this cycle, even as token prices swing.

Strategy Adds $2.13B in Bitcoin as Volatility Persists

Michael Saylor’s bitcoin-focused firm Strategy disclosed another large BTC purchase this week, adding roughly $2.13 billion worth of bitcoin over an eight-day span. The move underscores continued institutional-style accumulation even as broader market sentiment has cooled and price action has stayed choppy. Reuters said the company acquired about 22,305 BTC and continues to frame bitcoin as a long-term treasury asset, despite volatility putting pressure on crypto-linked equities. For the market, the takeaway is mixed: big buyers are still stepping in, but flows and sentiment indicators suggest many participants are staying cautious near-term.

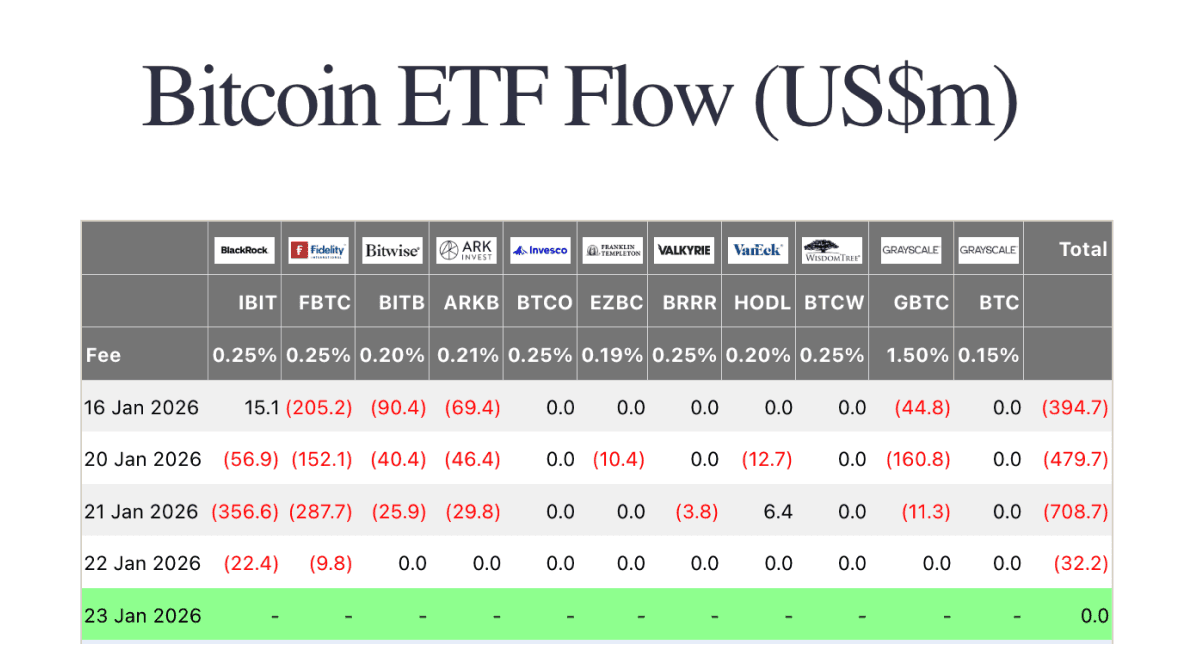

Bitcoin ETF Flows

Bitcoin ETFs opened the week with heavy net outflows of $479.7 million, led by redemptions from Fidelity’s FBTC (-$152.1m) and Grayscale’s GBTC (-$160.8m), alongside losses from BlackRock’s IBIT (-$56.9m). Outflows accelerated the following session to $708.7 million, as IBIT (-$356.6m) and FBTC (-$287.7m) accounted for most of the selling, partially offset by a small inflow into VanEck’s HODL (+$6.4m). Midweek pressure eased notably, with the lightest day seeing net outflows of just $32.2 million, driven mainly by IBIT and FBTC. Overall, the period was characterized by sustained redemptions across major issuers, reinforcing a defensive tone in institutional bitcoin positioning.

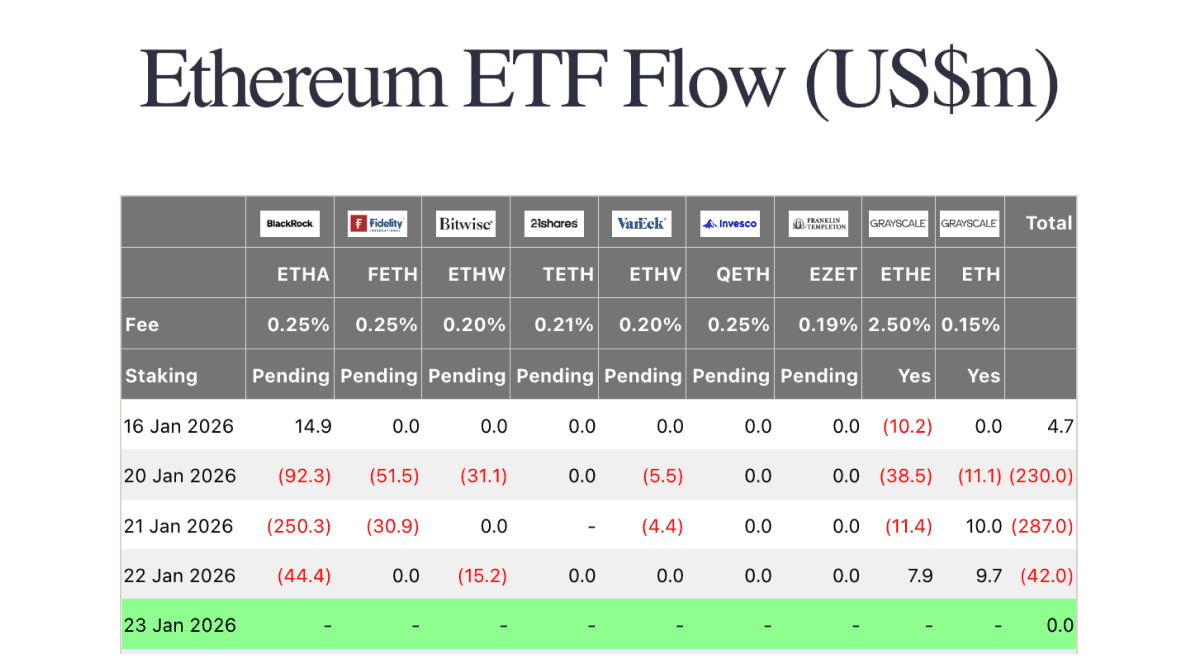

Ethereum ETF Flows

Ethereum ETFs began the week with net outflows of $230.0 million, led by BlackRock’s ETHA (-$92.3m) and Fidelity’s FETH (-$51.5m), with additional pressure from Grayscale’s ETHE (-$38.5m). The following session saw outflows deepen to $287.0 million, as ETHA (-$250.3m) dominated activity, while modest inflows into Grayscale’s ETH (+$10.0m) provided limited relief. Midweek flows moderated, with the weakest session totaling $42.0 million in net outflows, as losses in ETHA and Bitwise’s ETHW (-$15.2m) were partly offset by inflows into ETHE and ETH. Overall, ethereum ETFs experienced persistent net outflows across the main trading days, reflecting cautious institutional sentiment.

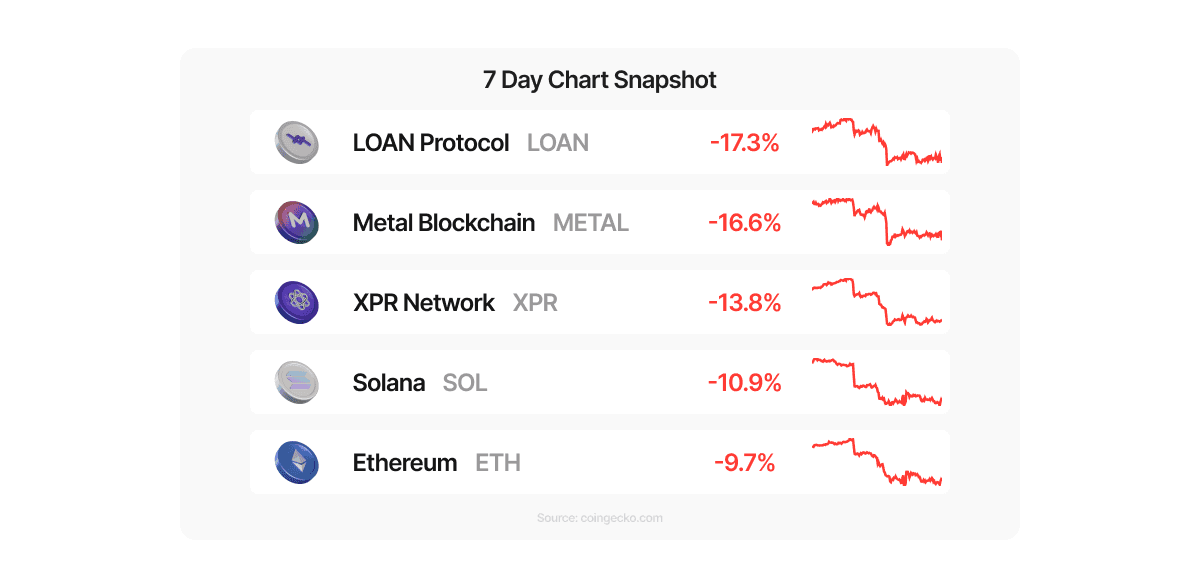

Top Movers (Coins Available on Metal Pay - 7 Day Chart)

This week’s biggest movers reflected broad-based downside pressure, with losses extending beyond smaller altcoins into major assets. LOAN Protocol led declines in tokens we track, falling 17.3% over seven days, followed by Metal Blockchain (-16.6%) and XPR Network (-13.8%). Notably, majors were not spared, with Ethereum (-9.7%) and Solana (-10.9%) also feeling the heat. The synchronized selloff across both majors and ecosystem tokens was largely driven by renewed macro uncertainty, as escalating tariff and trade policy discussions weighed on global risk appetite and prompted defensive positioning across crypto markets.

Trade these digital assets, and more - directly in Metal Pay.