Feb 20, 2026

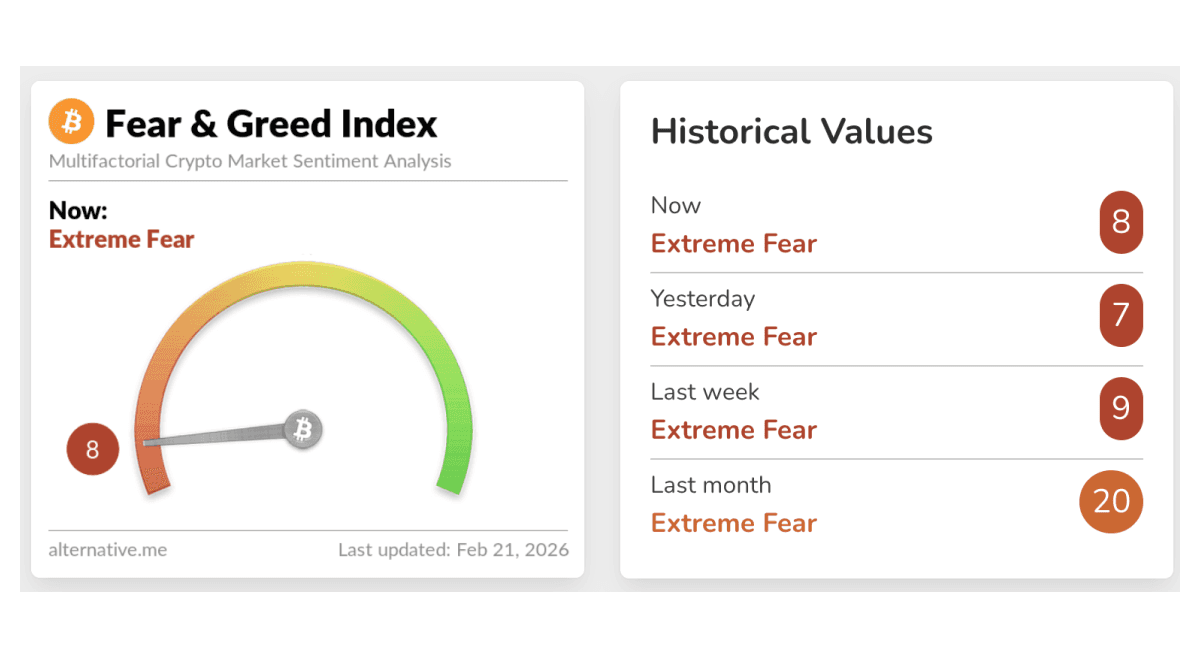

Crypto sentiment remained pinned in “Extreme Fear” this week, with the Fear & Greed Index reading 8 (vs. 9 last week), underscoring how cautious positioning still is after the recent shakeout. In broader markets, investors continued to parse mixed U.S. data and shifting risk appetite, with bitcoin and other majors moving alongside wider macro headlines rather than on a single crypto-specific catalyst. The gap between mood and price action stayed notable: even modest rebounds are being met with skepticism, and flows have been choppy. For everyday investors, the setup reads less like euphoria and more like a market still trying to find stable footing.

Tether’s Scale Draws Fresh Scrutiny as USDT Dominates Stablecoins

Tether’s USDT remained the biggest piece of crypto’s plumbing, and Reuters flagged renewed debate over how much systemic risk sits in a single issuer as USDT supply and influence keep expanding. The commentary highlighted Tether’s profitability alongside concerns around transparency and how shifts toward riskier reserves could matter in a stress event. The key takeaway for the broader market is simple: stablecoins are still the rails for liquidity, trading, and on-chain settlement, so confidence in their backing matters disproportionately. Any loss of trust would likely ripple quickly across pricing and venue liquidity given USDT’s role in global crypto markets.

Ethereum Foundation Publishes 2026 Protocol Priorities

The Ethereum Foundation published its protocol priorities update for 2026, outlining a roadmap centered on scaling capacity, improving user experience, and hardening core security. The post framed the work as a continuation of recent upgrades, with an emphasis on increasing throughput and making Ethereum easier to use without sacrificing decentralization goals. For users, the practical implication is that Ethereum’s core R&D is still aiming to push more activity on-chain while smoothing wallet and transaction UX over time. The update also signaled how the foundation is organizing engineering effort and trade-offs as the network plans its next phase of upgrades.

WebAuth Wallet Adds Support for XRPL

WebAuth Wallet has added native support for the XRP Ledger (XRPL), expanding passkey-based wallet access to one of the longest-running blockchain networks. The update allows users to create and manage XRPL accounts using WebAuthn authentication standards, replacing traditional seed phrases with device-based biometric security. By leveraging passkeys, the integration aims to improve usability and reduce friction for both retail users and developers building XRPL-based applications. The move reflects growing demand for hardware-backed authentication and simpler onboarding across multi-chain environments. As XRPL activity evolves, secure and user-friendly wallet infrastructure remains a key layer of adoption.

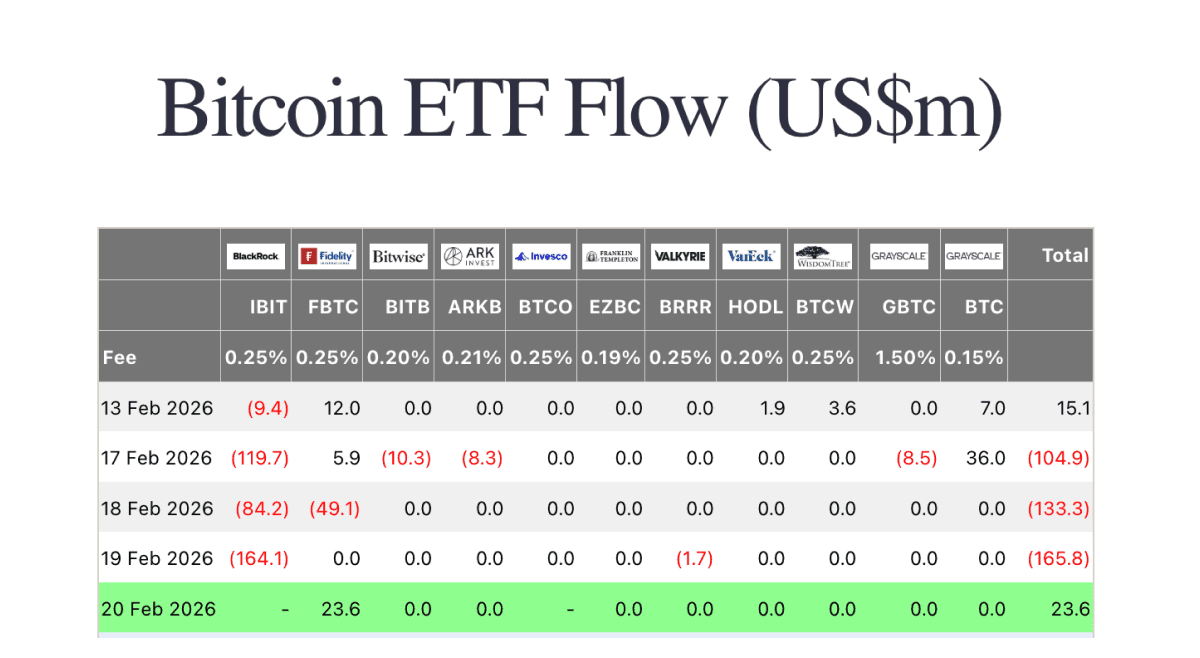

Bitcoin ETF Flows

With U.S. markets closed Monday for Presidents’ Day, Tuesday opened the week with $104.9m of net outflows, led by BlackRock’s IBIT (-$119.7m), partially offset by Grayscale’s BTC (+$36.0m) and Fidelity’s FBTC (+$5.9m). Wednesday saw deeper redemptions of $133.3m, driven primarily by IBIT (-$84.2m) and FBTC (-$49.1m). The weakest session came Thursday with $165.8m of net outflows, almost entirely from IBIT (-$164.1m). By Friday, flows flipped positive with a $23.6m net inflow, entirely from FBTC. Overall, the week skewed decisively risk-off despite a modest rebound into the close.

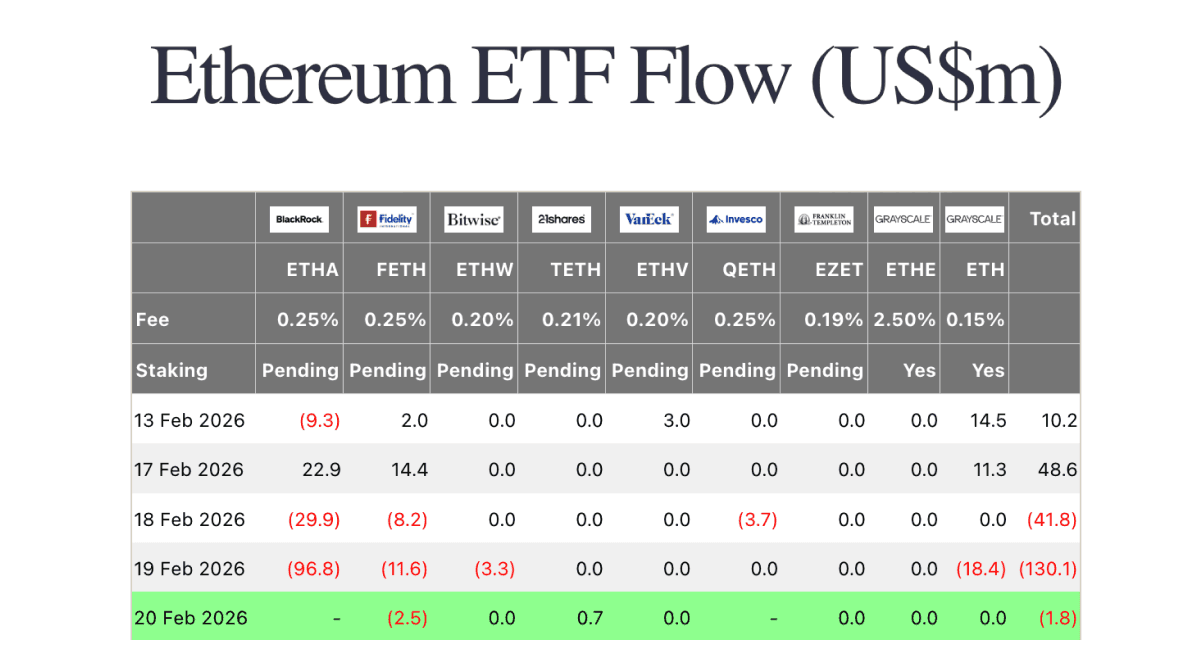

Ethereum ETF Flows

With Monday closed for the U.S. holiday, Tuesday began with $48.6m of net inflows, led by BlackRock’s ETHA (+$22.9m), Fidelity’s FETH (+$14.4m), and Grayscale’s ETH (+$11.3m). Wednesday reversed lower with $41.8m of net outflows, as ETHA (-$29.9m) and FETH (-$8.2m) drove redemptions. The weakest session was Thursday at $130.1m in net outflows, dominated by ETHA (-$96.8m) alongside additional FETH and Grayscale ETH selling. Friday flows were nearly flat but slightly negative at -$1.8m. Overall, ETH ETFs followed a similar midweek risk-off pattern after a strong start.

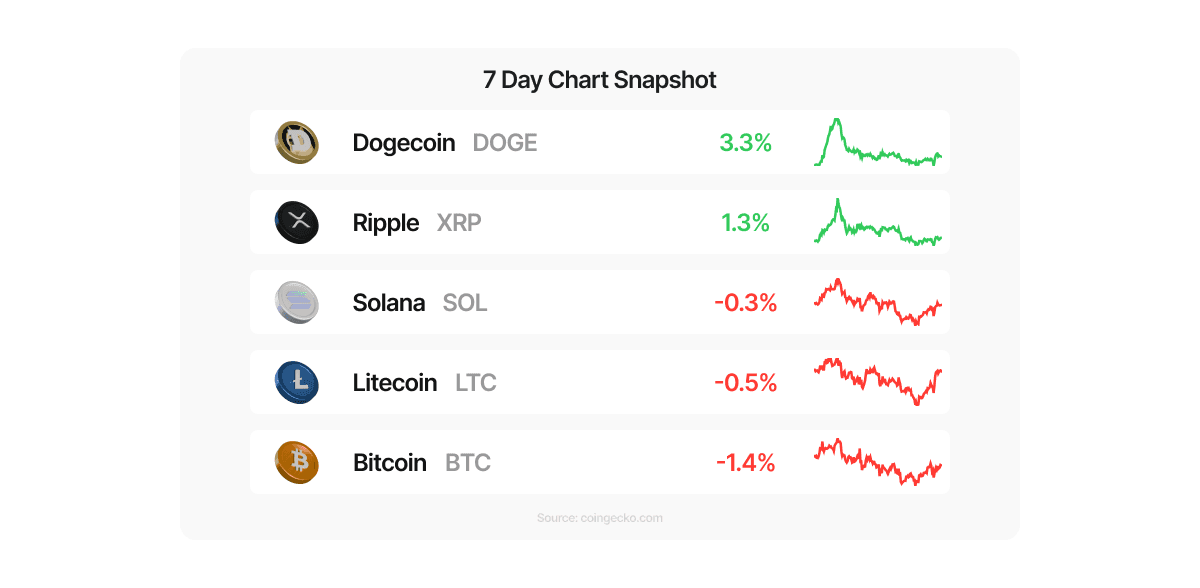

Top Gainers (Coins Available on Metal Pay)

Dogecoin (DOGE) led the weekly snapshot, rising 3.3% and standing out as one of the few clear positives during a cautious week. XRP also remained in the green (+1.3%), while Solana (-0.3%), Litecoin (-0.5%), and Bitcoin (-1.4%) posted only modest pullbacks. In a broader tape marked by extreme fear, these larger-cap names largely absorbed volatility rather than breaking down, suggesting rotation favored liquidity and established assets over speculative outperformance.

These coins and more, available on Metal Pay.