Jan 16, 2026

US Senate crypto bill delayed after stablecoin rewards dispute

A key U.S. crypto market-structure bill hit a delay this week after Coinbase publicly opposed the latest version, prompting the Senate Banking Committee to pause its planned action. The fight centered on how the bill would treat rewards tied to stablecoin holdings, an issue banks have warned could accelerate deposit flight. The delay highlights how policy details around consumer “yield” and rewards are becoming a major fault line for U.S. crypto regulation. For users, the immediate impact is continued regulatory uncertainty around exchanges, stablecoin programs, and tokenized financial products while lawmakers revisit the language.

Visa highlights accelerating use of stablecoins for settlement

Visa executives said this week that stablecoins are becoming a more significant settlement layer within global payments, citing rising volumes and broader experimentation by financial institutions and fintech firms. The company framed stablecoins less as speculative assets and more as infrastructure that can move value faster and more efficiently than legacy rails. Visa’s comments reinforce a broader industry shift toward on-chain settlement for cross-border and wholesale transactions. The pace of adoption, however, will depend on how regulators and banks finalize rules around custody, compliance, and integration with existing payment systems.

SEC no-action letter clears path for a payments-and-rewards token

A Texas homebuilder said it received an SEC “no-action” letter supporting the launch of a crypto token designed for payments and customer rewards rather than investment. The planned token would be used for spending via a wallet and payment card, with rebates and discounts structured as rewards instead of securities-style returns. While this is a niche issuer, the bigger signal is that U.S. regulators may be willing to provide clearer lanes for consumer rewards programs when they are tightly scoped and avoid profit-sharing features. For the broader market, it’s another data point on how compliant tokenized rewards may be structured going forward.

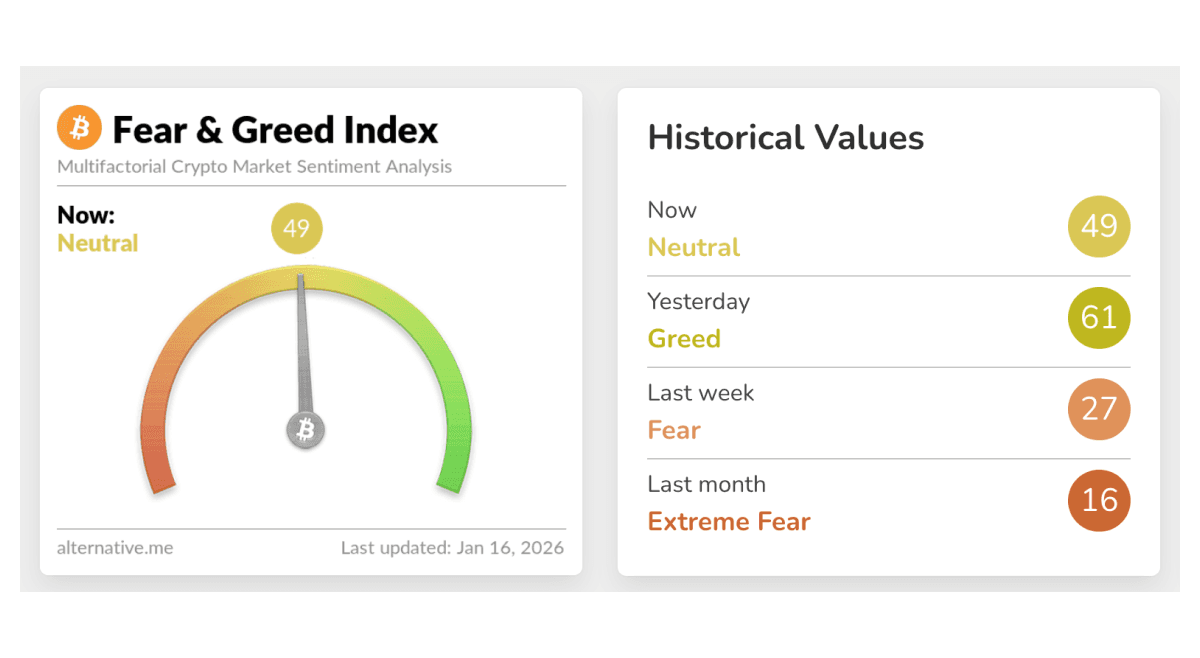

Crypto Fear & Greed Index

Crypto market sentiment has moved back into Neutral (49) for the first time in roughly a month, marking a notable shift from the extreme fear conditions seen in December. Just days ago the index briefly touched Greed (61), while last week it sat at Fear (27) and last month at Extreme Fear (16). The return to neutral suggests selling pressure has eased and positioning is becoming more balanced, with neither panic nor euphoria dominating market behavior. Historically, neutral readings often appear during consolidation phases, where markets digest prior volatility before choosing a clearer directional trend. In this context, sentiment stabilization aligns with improving ETF flows and steadier price action across major assets.

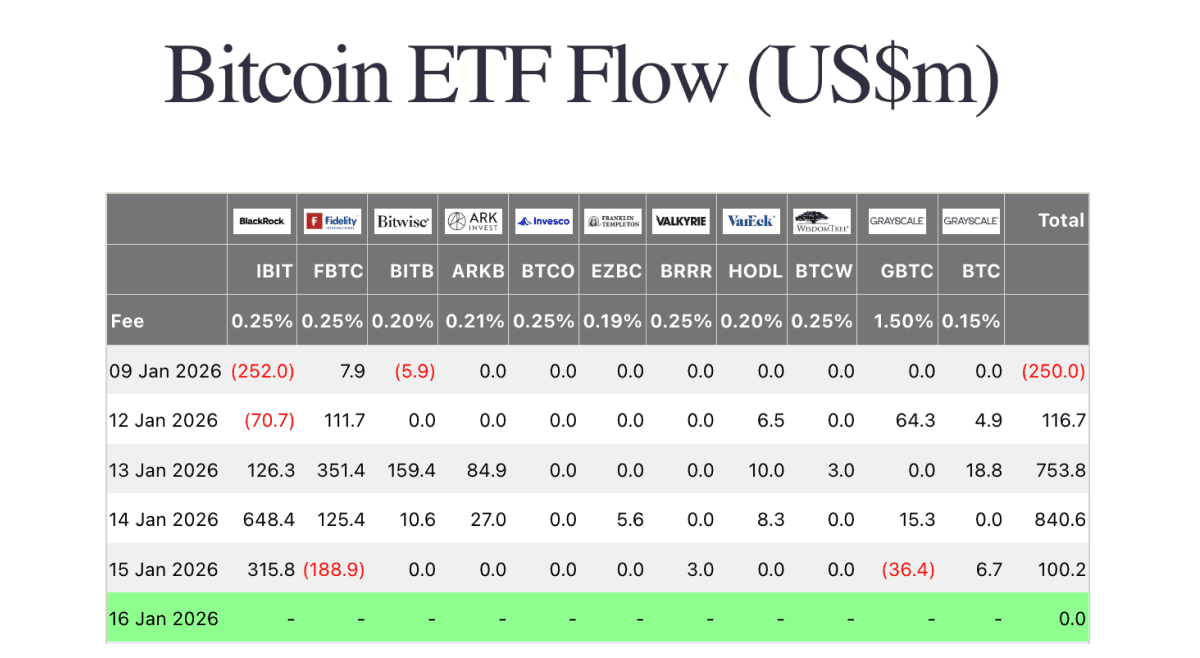

Bitcoin ETF Flows

Bitcoin spot ETFs started the week with net inflows of $116.7m on Monday, led by Fidelity’s FBTC (+$111.7m) and Grayscale’s GBTC (+$64.3m), while BlackRock’s IBIT saw -$70.7m. Tuesday accelerated with $753.8m of net inflows, paced by FBTC (+$351.4m) and IBIT (+$126.3m) alongside strength in Bitwise’s BITB (+$159.4m). The strongest day midweek was Wednesday at $840.6m as IBIT dominated (+$648.4m), while Thursday cooled to $100.2m as IBIT inflows (+$315.8m) were partly offset by FBTC outflows (-$188.9m) and GBTC (-$36.4m). Overall, flows swung sharply higher after last Friday’s -$250.0m, with strong midweek demand driving a net-positive run into the end of the snapshot.

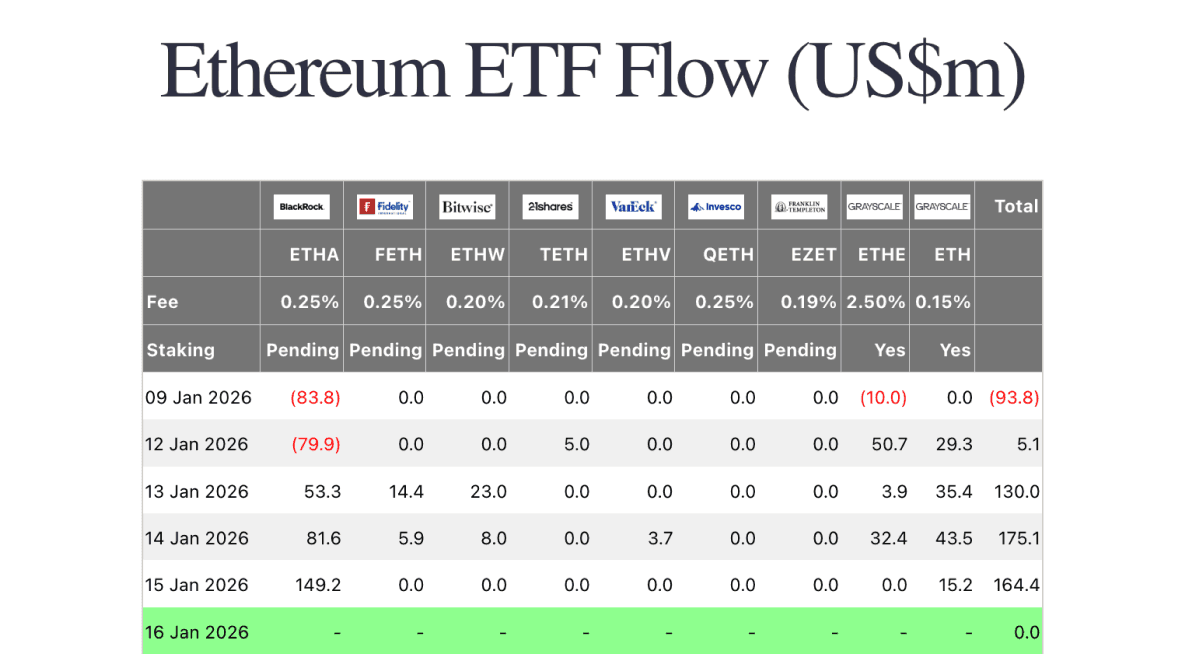

Ethereum ETF Flows

Ethereum spot ETFs opened the week with a modest $5.1m net inflow on Monday as Grayscale’s ETHE (+$50.7m) and Grayscale’s ETH (+$29.3m) outweighed a large BlackRock ETHA outflow (-$79.9m). Tuesday strengthened to $130.0m of net inflows, led by ETHA (+$53.3m) and Grayscale’s ETH (+$35.4m) with additional support from Bitwise’s ETHW (+$23.0m). The biggest midweek day was Wednesday at $175.1m as ETHA (+$81.6m) and Grayscale’s ETH (+$43.5m) led, while Thursday remained firm at $164.4m driven primarily by ETHA (+$149.2m). Overall, flows improved materially versus last Friday’s -$93.8m, with three consecutive inflow days signaling steadier demand through the week.

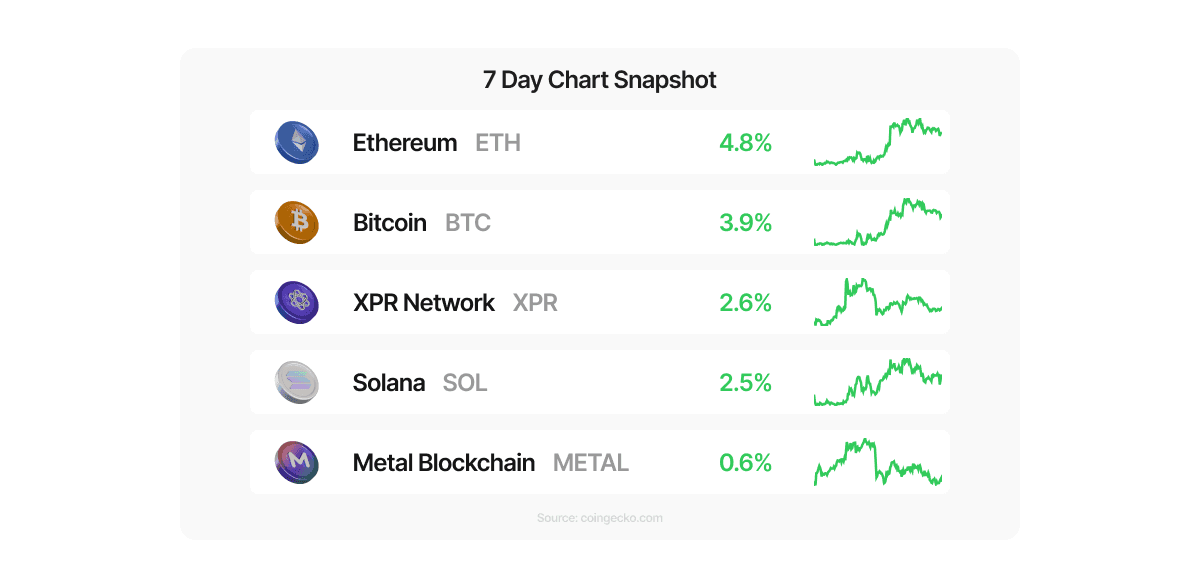

Top Movers (Coins Available on Metal Pay - 7 Day Chart)

Ethereum (ETH) led Metal Pay’s 7-day gainers, rising 4.8% and slightly outpacing Bitcoin’s 3.9% move as spot ETF demand for both assets improved midweek. XPR Network (XPR) added 2.6% and Solana (SOL) gained 2.5%, extending the week’s risk-on tone across large-cap alt exposure. Metal Blockchain (METAL) was up 0.6%, holding a small edge into the weekly close. In the background, stablecoin policy debates in Washington and continued institutional focus on stablecoin settlement kept attention on the “rails” side of crypto, while ETF flow strength helped support majors.

Build your own crypto stack without timing the market. Set automatic buys, choose your schedule, and invest consistently over time.