Feb 13, 2026

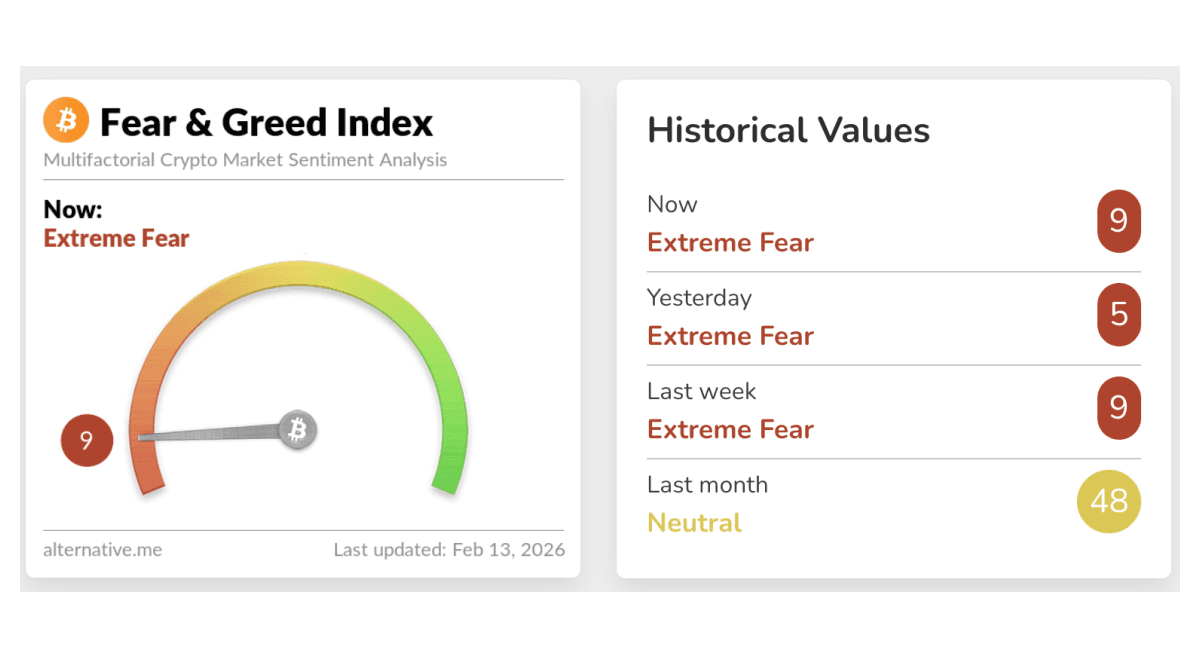

Crypto sentiment remained locked in “Extreme Fear” this week, with the Fear & Greed Index holding at 9 as volatility continued across majors. U.S. spot Bitcoin and Ethereum ETFs saw heavy midweek outflows, including more than $400 million in Bitcoin outflows on Thursday, before price action began stabilizing into the end of the week. For everyday investors, periods like this often mark emotional extremes rather than structural breakdowns. Historically, prolonged fear has coincided with long-term accumulation phases as leverage flushes out and stronger hands step in. With volatility elevated and liquidity rotating defensively, markets appear to be recalibrating rather than collapsing.

Bithumb Error Briefly Jolts Markets, Sparks Regulator Scrutiny

South Korean exchange Bithumb said an internal processing error during a promotion resulted in users receiving large amounts of bitcoin by mistake, triggering a brief bout of market stress and forced the platform to rapidly restrict activity. The incident prompted swift attention from local regulators, who raised concerns about operational controls and potential inspection actions. Bithumb said the problem was not a hack, and that most of the mistakenly distributed bitcoin was recovered after accounts were frozen. The episode was a reminder that operational risk, not just price volatility - can still move markets and invite regulatory pressure at the worst possible time.

Treasury Pushes for Clarity Act as Volatility Tests Confidence

U.S. Treasury Secretary Scott Bessent urged Congress to move quickly on a digital-asset market structure bill, arguing that clearer federal rules could help stabilize sentiment after the recent volatility. In public comments, he framed legislation as a way to reduce uncertainty for investors and firms operating in the space, while acknowledging ongoing political and industry disagreements. The renewed push underscores how regulatory direction, alongside macro conditions - continues to shape crypto’s risk premium. For market participants, the message was clear: Washington wants momentum on rules, but timelines and final policy details remain a key swing factor for 2026.

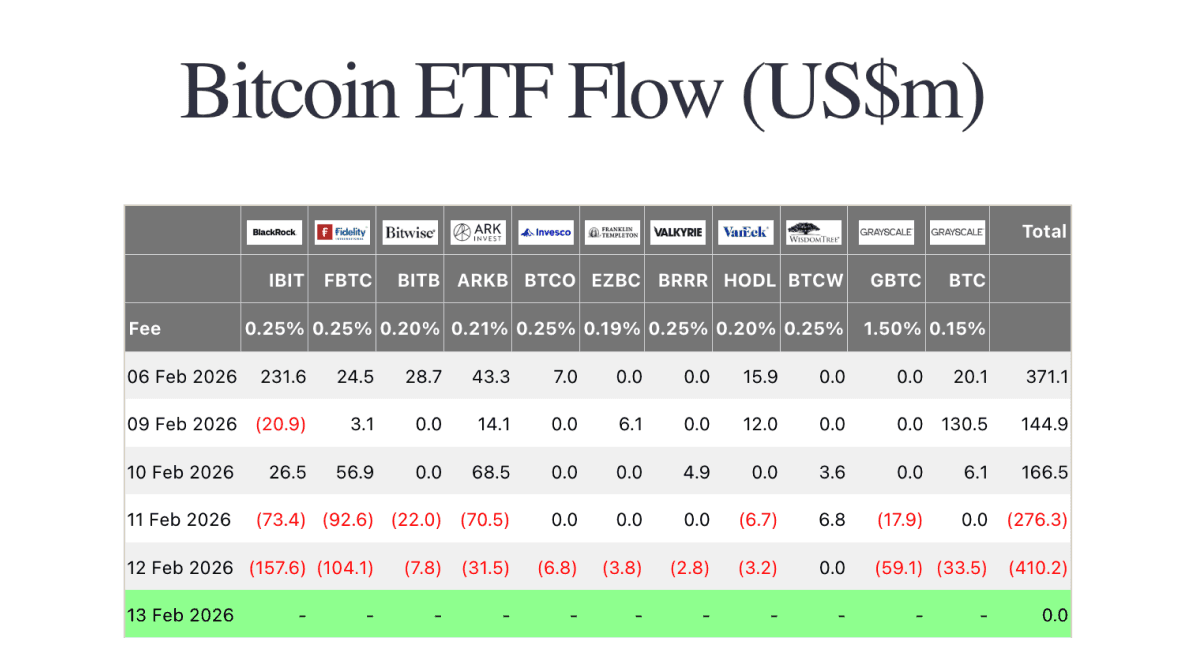

Bitcoin ETF Flows

Monday saw net inflows of $144.9m, led by Grayscale’s BTC (+$130.5m) alongside ARKB (+$14.1m) and HODL (+$12.0m), even as IBIT posted a -$20.9m outflow. Tuesday extended the rebound with $166.5m of inflows, paced by ARKB (+$68.5m), FBTC (+$56.9m) and IBIT (+$26.5m). Midweek turned sharply lower: Wednesday recorded -$276.3m (driven by FBTC -$92.6m, IBIT -$73.4m and ARKB -$70.5m), and Thursday worsened to -$410.2m as IBIT (-$157.6m) and FBTC (-$104.1m) led broad redemptions. Including the prior Friday’s +$371.1m inflow, weekly flows finished essentially flat overall, with early-week strength offset by heavy midweek outflows.

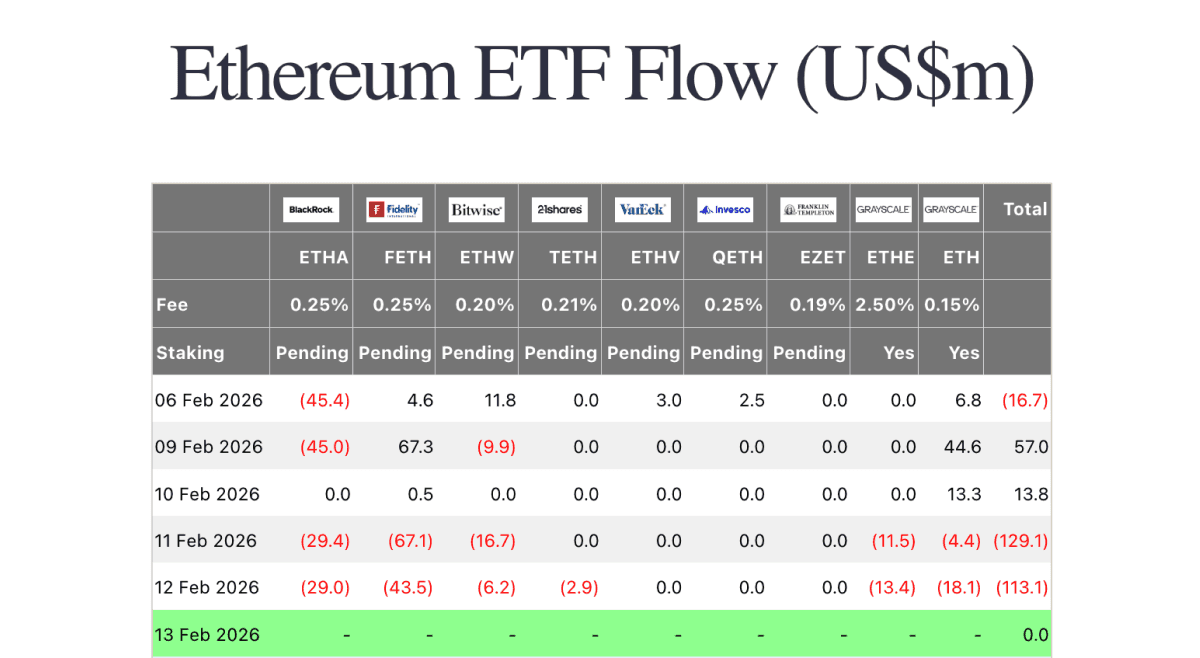

Ethereum ETF Flows

Monday posted net inflows of $57.0m, led by FETH (+$67.3m) and ETH (+$44.6m), despite ETHA seeing a -$45.0m outflow. Tuesday stayed positive but lighter at $13.8m, driven mainly by ETH (+$13.3m). Midweek flipped decisively risk-off: Wednesday saw -$129.1m of outflows led by FETH (-$67.1m) and ETHA (-$29.4m), and Thursday followed with another -$113.1m as FETH (-$43.5m) and ETHA (-$29.0m) again dominated redemptions. Including the prior Friday’s -$16.7m outflow, the week ended net negative overall, with early inflows overwhelmed by sustained midweek selling pressure.

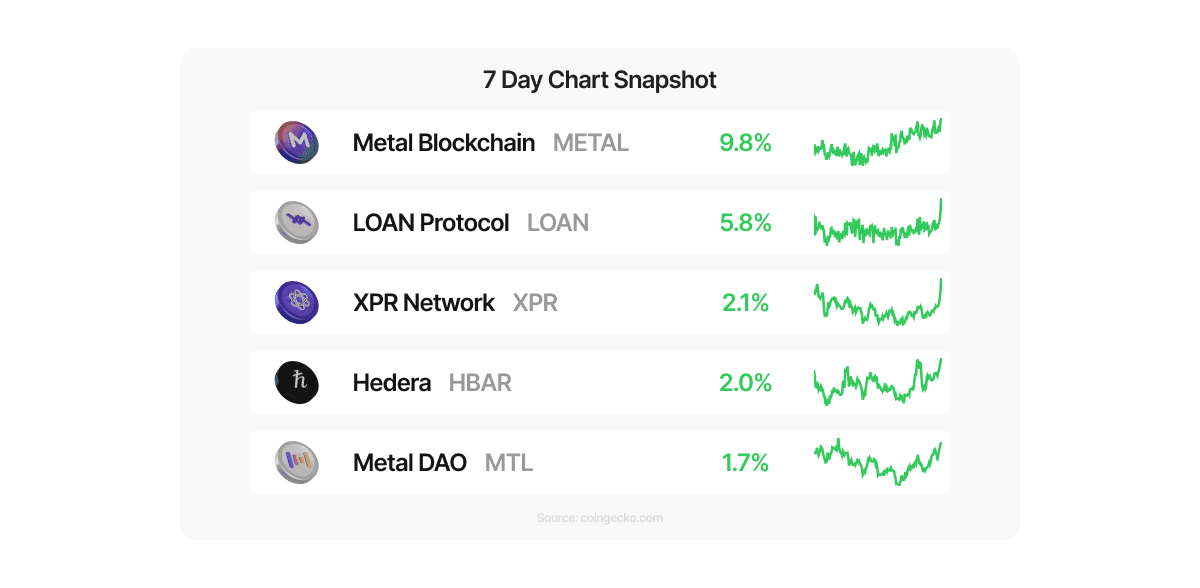

Top Movers (Coins Available on Metal Pay - 7 Day Chart)

Even with market sentiment stuck in Extreme Fear this week, Metal ecosystem names held up well. Metal Blockchain (METAL) led the pack with a 9.8% gain over seven days, followed by LOAN Protocol (+5.8%) and Metal DAO (MTL) (+2.1%). Hedera (HBAR) added +2.0% and XPR Network (XPR) finished up +1.7%, showing pockets of resilience as traders selectively rotated into names with stronger relative strength while broader majors stayed volatile.